Whether your child is two years old or 12 years old, it’s never too late (or too early) to start saving and planning for college. We asked UWorld’s own Chartered Financial Analyst, Dave Malone, a few questions about saving for college. Here is what he had to say . . .

What is a 529 plan?

A 529 Plan is a potentially tax-free way to save for college. It is very similar to a Roth IRA. Contributions are made on an after-tax basis but grow on a tax-deferred basis. In 529 Plans, if the withdrawal is considered a qualified distribution (eg, payment for tuition, fees, room and board) then NO TAXES are paid. It is a tax-free way to save. “529” comes from Section 529 of the US tax code. It authorizes states, specifically governors to create the plan. They usually hire record keepers and investment managers to run the plan and offer investments. Some states offer additional tax benefits so if you reside in those states you should consider those plans before others

How much money should I set aside each month?

The amount of money one should save for college is a function of the expected cost of attending college and your ability to save. Realizing that the total cost of attending college today is nearing $100,000 PER YEAR, most families may feel this is an unattainable goal. Doing a minimum monthly contribution (automatic investment plan) is common and the minimums are very low. For every dollar saved in a 529 plan, it eliminates 3 dollars in borrowing and interest.

My child has already started high school. If I didn’t start saving when he was younger, what can I do now to prepare?

Some plans offer links to share with friends and family to make college gifts instead of toys or gift cards. Another option is to make an accelerated contribution up to 5 times the legal gift limit of $15,000 for a total of $60,000 per account holder. That could mean that 2 grandparents could give a total of $120,000 in one year to one grandchild.

I’ve heard different opinions about student loans. Are they a wise financial option?

It is better to save than to borrow. If you must borrow, try to avoid those with “origination fees” which are effectively paying interest on the money you have not yet borrowed. Many banks are competing for your business so take the time and shop around. Also, consider having the student have some skin in the game. As a father of four, having my children sign a promissory note (“Dad what’s a promissory note?) is very beneficial for them. It is eye-opening and makes them think before missing an 8:00 am Chemistry class.

W. David Malone, CFA is a Chartered Financial Analyst who has managed other peoples’ money for over 20 years. This experience included helping families, small businesses, and institutions. Most recently, Dave was responsible for overseeing $68+ billion in 529 Plan assets. Dave graduated from Tulane University in 1990 with a BS in Management and Boston College with an MS in Finance in 1996. He passed the CPA Exam in 1991 and the Series 65 Exam in 2013.

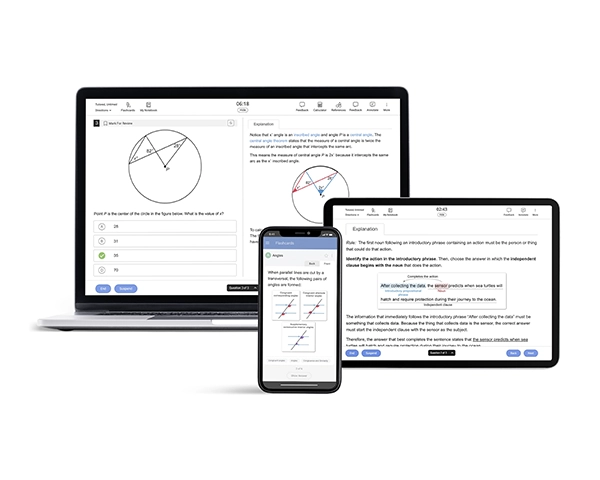

Is your child preparing for an upcoming SAT® or ACT® exam? If so, check out UWorld’s FREE trial subscription to see how we can help. Our exam-like questions, detailed explanations, and performance predictor will have your child confident on test day and ready to perform at his or her best. A dream school requires a dream score. We help make those dreams come true.