Free Application for Federal Student Aid (FAFSA®) is the form you fill out in order to access financial aid from the federal government, states and colleges to help with your educational expenses. These expenses include tuition and fees, room and board, books, transportation, and other education-related costs.

Filling out the FAFSA form is key to accessing grants, scholarships, work-study programs, and federal loans. Accessing financial aid can be confusing, but we’ve got your back. Read on to learn everything you need to know about federal aid types, eligibility requirements, and tips on how to maximize your financial aid.

Why Is FAFSA Important?

The purpose of the FAFSA is to simplify the way in which students can access and apply for federal financial aid. Every year, the Department of Education sets aside over 120 billion dollars in federal grants, low-interest loans, and work-study awards. These funds bring financial relief to over 13 million college students each year.

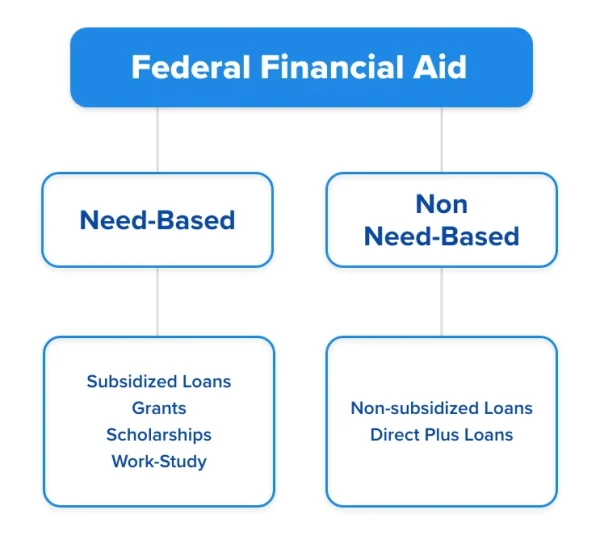

The FAFSA form gives you access to two broad categories of financial aid: need-based aid and non-need-based aid. Completing the FAFSA is mandatory to be eligible for any of these options. If you’re seeking financial assistance to cover your college expenses, getting your FAFSA done is the crucial first step.

The amount of aid you receive through FAFSA is based on the following factors:

- Expected Family Contribution (EFC): This is the amount of college tuition your family/guardian or you can afford to pay.

- Cost of attendance (COA) at your prospective school, which includes your tuition, accommodation, stationary, travel, and other essential requirements.

- Your school year

- Your enrollment status (as a full-time or part-time student) at the institution to which you’re applying for aid.

Who Is Eligible for Financial Aid?

Perhaps you believe that you are not eligible for financial aid. However, you could be pleasantly surprised. Regardless, it is worth exploring the opportunity to potentially save thousands of dollars on educational expenses. Listed below are the factors that determine your financial aid eligibility.

- You must be a U.S. citizen or an eligible non-citizen, such as a permanent resident.

- You must be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program at a participating school.

- Male students must be registered with the Selective Service System.

- You must maintain satisfactory academic progress (SAP) while in school as defined by the institution. SAP is evaluated through your GPA or semester hours that you put towards the successful completion of your college coursework.

- You must be able to demonstrate your financial need, which is calculated as the difference between the cost of attendance (COA) for your college course and the expected family contribution (EFC) that you can cover.

- If you have defaulted on a federal student loan or have a criminal conviction, you may be ineligible for federal student aid.

Note that there may be some additional eligibility requirements for specific federal financial aid programs. Be sure to check those out on the Federal Student Aid website.

Can international students fill out the FAFSA?

No, international students cannot fill out the FAFSA form. Federal financial aid is limited to US citizens and permanent non-citizens, as mentioned above.

My parents probably earn too much money. Is filling out the FAFSA a waste of time?

There is no set income limit to qualify for financial aid via FAFSA. The only way to find out if you are eligible for assistance is to apply. You might be surprised. Millions of dollars are left unclaimed each year, so don’t miss out because you assume you won’t be eligible.

An important point to note is that filling out the FAFSA goes beyond federal assistance. Many states and colleges utilize your FAFSA to determine your eligibility for their scholarships, grants, work-study programs, and merit awards. So, completing the FAFSA can open up a range of opportunities for additional financial support beyond the federal level.

Types of financial aid you can get through FAFSA

The financial aid office at your college or school will determine how much financial aid you are eligible to receive.

Based on your financial need and eligibility, there are two broad categories of federal financial aid: “need-based” and “non-need-based”. Each category is further divided into loans, grants, and work-study arrangements.

- Grant is a type of financial aid that you generally do not need to repay.

- A loan is an amount that you borrow for college and repay with interest. Depending on your financial aid eligibility, your loan interest rate can be subsidized or unsubsidized.

- Work-Study is a federal work program through which you can earn money to pay for school.

How to Fill Out FAFSA?

The steps listed below will help you fill out your FAFSA form. But before that, let’s go through the checklist of documents you’ll need:

Your Social Security number (SSN)

Alien Registration number if you’re an eligible noncitizen

Your driver’s license (if any)

Documentation showing that you are a U.S. permanent resident or other eligible noncitizen

Federal income tax returns, W-2 forms, and other financial records from the previous two years to demonstrate your or your parents’ income

Any untaxed income, taxable earnings from work-study programs, and records of grants, scholarships, and fellowship aid

IRS Form 1040, foreign tax return, or tax return from U.S. territories

Any untaxed income records (payments to tax deferred pension and savings plans, tax exempt interest, child support) for two years prior

Records of taxable earnings from Federal Work-Study or other need-based work programs

Records of any grants, scholarships, and fellowship aid that was included in your or your parents’ adjusted gross income (AGI)

Any current bank statements, current business and investment mortgage information, business and farm records, stock, bonds and other investment records

Step 1: Create an FSA ID

Once you have the documents ready, you should create your personal Federal Student Aid ID. This ID will allow you to fill out the form online and access information about your financial aid in the future. Remember to keep a record of your FSA ID. You will need it to renew your FAFSA application every year.

Step 2: Fill out the FAFSA form

Right after creating your FSA ID, you will be able to fill out your FAFSA application form. But before you do that, there are a few things to keep in mind:

- Aid is considered on first-come first-served basis, provided you meet other eligibility criteria listed above

- Find out your dependency status

- Submissions are open from October 1 to June 30 of the following year

- Check college, state and federal FAFSA Deadlines for 2023-24.

FAFSA contains three sets of questions:

- Your personal information (name, email, marital status, etc.)

- Financial information (e.g. your income and assets)

- Information on your legal parents (if you’re a dependent student)

While you fill out the form, use the FAFSA financial aid calculator to get an estimate of your federal student aid eligibility. This will help you understand your options to pay for college early so that you can start planning your expenditures.

Step 3: Submit the FAFSA form and review your Student Aid Report (SAR)

You must resubmit the FAFSA every year to renew your federal aid status. After you’ve submitted the form, you will receive the Student Aid Report (SAR). This document summarizes the information you provided on your FAFSA form, and informs you whether you’ve been selected for verification. It can take anywhere between 3-5 days to three weeks to receive your SAR.

Step 4: Review financial aid offers

After you receive the SAR, your prospective college or career school will put together a financial award letter/package detailing the type of aid you're eligible for and the amount of aid granted. Your task is to review the letter, decide on the aid type and amount, and finalize your package. The letter will contain the instructions you need to follow in order to accept, revise and claim your financial aid.

Frequently Asked Questions (FAQ’s)

In most cases, getting college credits through AP exam scores won’t affect your financial aid. AP credits can help you finish your studies faster and move ahead in your program. But remember, financial aid depends on factors like your family’s income and financial situation. Although AP credits can impact your course placement and progress, they don’t directly change your financial aid eligibility. Consult with your college’s financial aid office for specific information tailored to your situation.

Searching for a reliable premium AP test prep? Try UWorld’s AP practice tests and question bank to prep faster and smarter!