Format of the AP Macroeconomics MCQ Section

The first section of the AP Macroeconomics exam, the MCQ section, makes up 66% of your overall exam score. It consists of 60 questions to be answered in 70 minutes, giving you around 40-45 seconds per question. All the questions require knowledge of economic concepts and reasoning across the following units of the course content:

| Units | Exam Weight |

|---|---|

| Unit 1: Basic Economic Concepts | 5–10% |

| Unit 2: Economic Indicators and the Business Cycle | 12–17% |

| Unit 3: National Income and Price Determination | 17–27% |

| Unit 4: Financial Sector | 18–23% |

| Unit 5: Long-Run Consequences of Stabilization Policies | 20–30% |

| Unit 6: Open Economy—International Trade and Finance | 10–13% |

The questions also test the following skills:

- Skill Category 1 (Principles and Models): To assess students' knowledge of economic principles and models

- Skill Category 2 (Interpretation): To assess how well students can define economic outcomes

- Skill Category 3 (Manipulation): To assess students' capability to evaluate the results of specific economic situations

How to Approach AP Macroeconomics Multiple-Choice Questions

Approaching AP Macroeconomics multiple-choice questions requires a systematic strategy. Here are a few tips to help you perform well in this section:

-

Ensure you read the questions carefully:

Before answering a question, understand what it's asking. To make it more manageable, break the question into smaller components. Highlight numbers, units, or important terms to form and solve equations.

-

Know the terminology:

Understanding the macroeconomics terms helps you interpret questions accurately, gather precise information from graphs and charts, and choose the most appropriate answer.

-

Use graphs and tables wherever possible:

While drawing graphs and tables may not be explicitly required in AP Macro MCQs, doing so can benefit you. It helps you organize your thoughts, prevents confusion, and helps you answer questions more precisely. It also enables you to comprehend specific data points or trends that may not be achievable through written information in the questions alone.

-

Answer all the questions:

Since there is no penalty for a wrong answer, answer every question. Try eliminating incorrect options to increase your chances of selecting the correct answer. If you still need to figure out the answer, try making an educated guess using reasoned and thoughtful inferences.

-

Skip and Revisit:

If you are stuck, skip that question and return to it later. This prevents you from running out of time and reduces stress and anxiety during the exam. Knowing you can revisit challenging questions later promotes a calmer mindset, enabling you to focus better on questions you can answer readily.

-

Know your calculator:

You can use a four-function calculator on both AP Macroeconomics exam sections. Make sure to bring the same calculator you practiced with to avoid getting stuck and making errors due to using an unfamiliar calculator.

AP Macroeconomics Multiple Choice Questions Examples

The following are examples of exam-like AP Macroeconomics multiple choice questions derived from the UWorld QBank.

| Assets | Liabilities | ||

|---|---|---|---|

| Reserves | $100,000 | Deposits | $1,000,000 |

| Loans | $700,000 | Debt | $90,000 |

| Securities | $300,000 | Equity | $10,000 |

MCQ Example 1

The balance sheet above shows the assets and liabilities of a bank. Based on the data above, which of the following must be true?

| A. | Additional deposits will result in a decrease in the bank's loans | ||

| B. | The bank's assets exceed its liabilities | ||

| C. | The value of loans must be greater than the value of securities | ||

| D. | The bank's equity must be 10% of its reserves | ||

| E. | The bank operates in a fractional reserve banking system |

Hint: This question assumes a limited reserves environment with a required reserve ratio greater than zero.

This question is from Unit 4: Financial Sectorbn and requires an understanding of banking and the expansion of the money supply.

A primary function of a bank is to loan people money. To fund loans, the bank takes in deposits from customers and uses those deposits to back loans to other customers.

For example, when Michelle deposits $10,000 at UWBank, the bank assumes that it is unlikely that she will want to withdraw the entire $10,000 from her account. Therefore, the bank may decide to lend out $1,000 to Byron, and the bank will hold the remaining $9,000 in reserves available for Michelle to withdraw at a future time.

| UWBank Assets | UWBank Liabilities | ||

|---|---|---|---|

| $10,000 Michelle's savings account | |||

| Loan to Byron | $1,000 | ||

| Reserves | $9,000 | ||

In a fractional reserve banking system, only a fraction of deposits made at the bank are held as reserves.

| Assets | Liabilities | ||

|---|---|---|---|

| Reserves | $100,000 | Deposits | $1,000,000 |

| Loans | $700,000 | Debt | $90,000 |

| Securities | $300,000 | Equity | $10,000 |

The balance sheet above indicates that the bank operates in a fractional reserve banking system because the bank's reserves of $100,000 are less than the $1,000,000 in deposits at the bank.

- (Choice A) Because banks hold only a portion of deposits as reserves, it is likely that this bank will make more loans when it receives additional deposits. There is no information on the bank's balance sheet to suggest that loans will decrease if additional deposits are made.

- (Choice B) The values of assets and liabilities must be equal on a balance sheet.

- (Choice C) The value of loans can exceed securities if the bank decides to allocate its assets in that way.

- (Choice D) Equity is the difference between total assets and other liabilities on a balance sheet, not a fixed percentage of reserves.

Therefore...

Correct Answer: E

Remember, in a fractional reserve banking system, a bank takes in deposits and makes loans backed by those deposits, resulting in the bank's deposits exceeding the value of its reserves.

MCQ Example 2

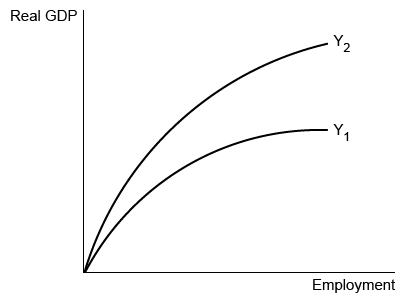

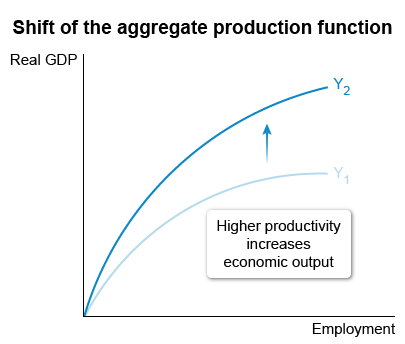

Which of the following shifts the aggregate production function from Y1 to Y2?

| A. | An increase in consumer spending | ||

| B. | An increase in interest rates | ||

| C. | An increase in the level of physical capital | ||

| D. | A decrease in input prices | ||

| E. | A decrease in short-run aggregate supply |

This question is from Unit 5: Long-Run Consequences of Stabilization Policies and requires an understanding of Economic Growth.

According to the aggregate production function, increasing the number of workers in an economy creates diminishing returns; real gross domestic product (GDP) increases but at a decreasing rate. Diminishing returns mean that economic growth slows as more workers are employed.

For an economy with diminishing returns to grow faster, human capital, physical capital, or technology must increase, thereby increasing productivity.

Workers produce more using physical capital, such as work gloves, delivery trucks, or computers. Therefore, increasing an economy's level of physical capital increases productivity, shifting the aggregate production function upward (Y1 to Y2).

The following choices are changes affecting short-run equilibrium but not productivity, and do not shift the aggregate production function upward:

- (Choice A) Increased consumer spending shifts the aggregate demand (AD) curve rightward.

- (Choice B) Increased interest rates decrease investment, shifting the AD curve leftward.

- (Choice D) A decrease in input prices shifts the short-run aggregate supply curve (SRAS) rightward.

- (Choice E) A decrease in SRAS shifts the SRAS curve leftward.

Therefore...

Correct Answer: C

Remember, Productivity increases when an economy adds to its stock of physical capital, as shown by an upward shift of the aggregate production function.

MCQ Example 3

Macrovia produces only calculators, pens, and macroeconomics workbooks. The following table shows prices and quantities of these products in three years.

| 2010 | 2020 | 2021 | ||||

|---|---|---|---|---|---|---|

| Price | Quantity | Price | Quantity | Price | Quantity | |

| Calculators | $10.00 | 50 | $15.00 | 60 | $16.00 | 60 |

| Packs of pens | $2.00 | 1,000 | $3.00 | 1,200 | $4.00 | 1,250 |

| Macroeconomics workbooks | $5.00 | 1,000 | $9.00 | 1,400 | $10.00 | 1,500 |

Assume that a market basket contains one calculator, two packs of pens, and four macroeconomics workbooks. If 2010 is the base year, Macrovia's consumer price index for 2021 is

| A. | 53.1 | ||

| B. | 112.3 | ||

| C. | 167.6 | ||

| D. | 176.5 | ||

| E. | 188.2 |

This question is from Unit 2: Economic Indicators and the Business Cycle and requires an understanding of the topic ‘Price Indices and Inflation’.

The consumer price index (CPI) is calculated using the cost of a fixed market basket in a given year and a base year's market basket cost according to the following formula:

CPI = Cost of base-year market basket at current prices / Cost of base-year market basket at base-year prices x 100

For Macrovia, the full market basket is one calculator, two packs of pens, and four macroeconomics workbooks. Macrovia's 2021 CPI, using 2010 as the base year, is calculated as follows:

| CPI2021 | = | Market basket (1 calculator + 2 packs of pens + 4 workbooks) cost in 2021 / Market basket (1 calculator + 2 packs of pens + 4 workbooks) cost in 2010 x 100 |

| = (1 x $16) + (2 x $4) + (4 x $10) / (1 x $10) + (2 x $2) + (4 x $5) x 100 | ||

| = $16 + $8 + $40 / $10 + $4 + $20 x 100 | ||

| = $64 / $34 x 100 = 188.2 |

As a result, if 2010 is the base year, Macrovia's consumer price index for 2021 is 188.2.

- (Choice A) (Choice A) The result of 53.1 comes from incorrectly inverting the numerator and denominator in the CPI formula.

- (Choice B) A CPI of 112.3 results from incorrectly using 2020 as the base year, rather than 2010.

- (Choice C) The CPI for 2020 is 167.6; however, the question asks for the CPI for 2021.

- (Choice D) The result of 176.5 uses only one of each item—instead of Macrovia's full market basket, which includes two pens and four workbooks—in the numerator and denominator.

Therefore...

Correct Answer: E

Remember, the CPI takes the cost of a fixed market basket in a given year and compares it with a base year's market basket cost.

MCQ Example 4

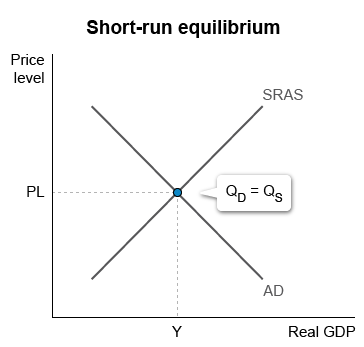

If the economy is in short-run equilibrium, which of the following is true?

| A. | The economy's current real output is less than its nominal output | ||

| B. | The economy's current level of output exceeds its full-employment level of output | ||

| C. | The quantity of output supplied equals the quantity of output demanded | ||

| D. | The economy's short-run output equals its long-run output | ||

| E. | The economy's actual inflation rate is less than its expected inflation rate |

This question is from Unit 3: National Income and Price Determination and requires an understanding of the Equilibrium in the Aggregate Demand-Aggregate Supply (AD-AS) Model.

Short-run equilibrium occurs where the short-run aggregate supply curve (SRAS) intersects the aggregate demand (AD) curve.

Short-run equilibrium is determined by the price level (PL) where the quantity of national output demanded (QD) equals the quantity supplied (QS).

- (Choice A) The difference between nominal output and real output results from inflation's effect on the measurement of gross domestic product and is unrelated to short-run equilibrium.

- (Choices B and D) An economy can be in short-run equilibrium coinciding with a recessionary output gap. If so, current (short-run) output is less than, not exceeding or equaling, the full-employment (long-run) level of output.

- (Choice E) Short-run equilibrium can coincide with an inflation rate that is either greater or less than the expected inflation rate.

Therefore...

Correct Answer: C

Remember, Short-run equilibrium occurs at the price level at which the quantity of national output demanded equals the quantity supplied.

How to Practice AP Macroeconomics Multiple-Choice Questions

Here are some study tips to help you excel in the AP Macroeconomics multiple-choice questions section:

- Start by familiarizing yourself with the format of the MCQ section. Check how many questions there are and the time and points allotted to them.

- Ensure a solid grasp of foundational macroeconomic concepts. See how different units are weighted in the AP Macro MCQ section and prepare accordingly. Topics with higher weight are more likely to appear on the exam.

- Take timed tests. This will help you manage your time effectively during the exam and improve your ability to analyze and answer questions quickly.

- Use resources like UWorld's AP Macroeconomics prep course, which comes with a thorough study guide and an extensive QBank. This will help you understand the difficulty level of the actual exam, review your performance, and adjust your study approach accordingly.

- Do as much AP Macro MCQ practice as possible. Pay close attention to the questions you answered incorrectly. Understand why you made those mistakes and strive to clarify any doubts.

Above all this, a study plan is pivotal to remain focused and have a structured framework for your preparation. If you need help with creating an AP Macroeconomics study plan, our guide is here for you! It will help you set realistic goals for each study session and ensure you cover all the units promptly before the exam.

Frequently Asked Questions (FAQs)

How are AP Macroeconomics MCQs graded?

How long is the multiple choice question section of the AP Macroeconomics?

Where can I get the AP Macroeconomics past exam multiple-choice questions?

References

- AP Macroeconomics. (2022). Collegeboard.org. Retrieved December 11, 2024, from https://apcentral.collegeboard.org/courses/ap-macroeconomics/exam

- AP Macroeconomics Course and Exam Description. (2022, Fall). Collegeboard.org. Retrieved Retrieved December 11, 2024, from https://apcentral.collegeboard.org/media/pdf/ap-macroeconomics-course-and-exam-description.pdf

Read More Related Articles

Struggling to understand AP Macro free-response questions? Explore our inclusive study guide designed to excel in understanding every question category within the FRQ section.

How to Study for AP MacroeconomicsAre you looking for top-notch materials for AP Macroeconomics preparation? Here is our detailed, step-by-step guide to facilitate your journey to achieving a 5 in the AP Macro exam.

About AP MacroeconomicsCurious to know about the AP Macroeconomics exam? Wondering about its relevance and level of difficulty? Find all your answers to these exam-related queries within this article.

AP Macroeconomics Exam FormatIn search of a comprehensive guide to the AP Macroeconomics exam format? Explore this guide that simplifies the exam structure, question types, and other essential components!