Mastering the AP Macroeconomics Formula Sheet

The AP Macroeconomics formula sheet is your ultimate study companion for acing the exam. It’s packed with essential formulas and graphs that simplify economic concepts. Whether you’re studying inflation, GDP, or monetary policy, this sheet helps you easily remember and apply what you’ve learned. Having it by your side during exam season will reduce stress and improve focus, giving you the confidence to master the exam.

Key AP Macro Formulas & Equations

Unit 1: Basic Economic Concepts

When given output values:

When given input values:

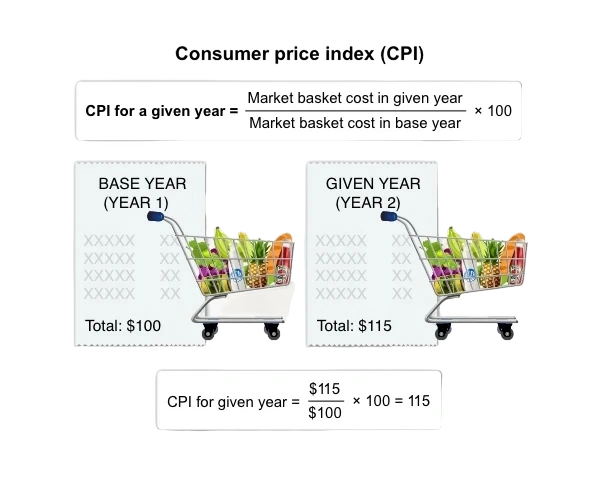

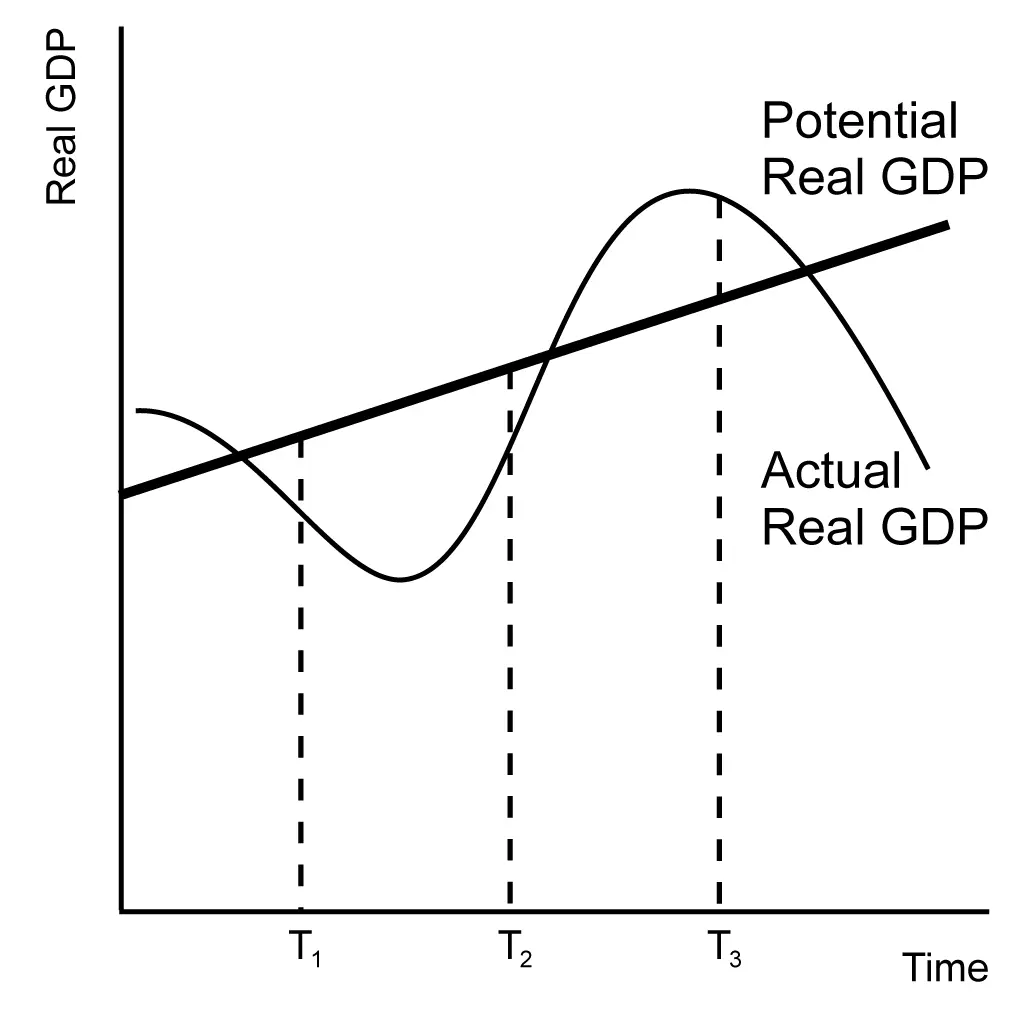

Unit 2: Economic Indicators & the Business Cycle

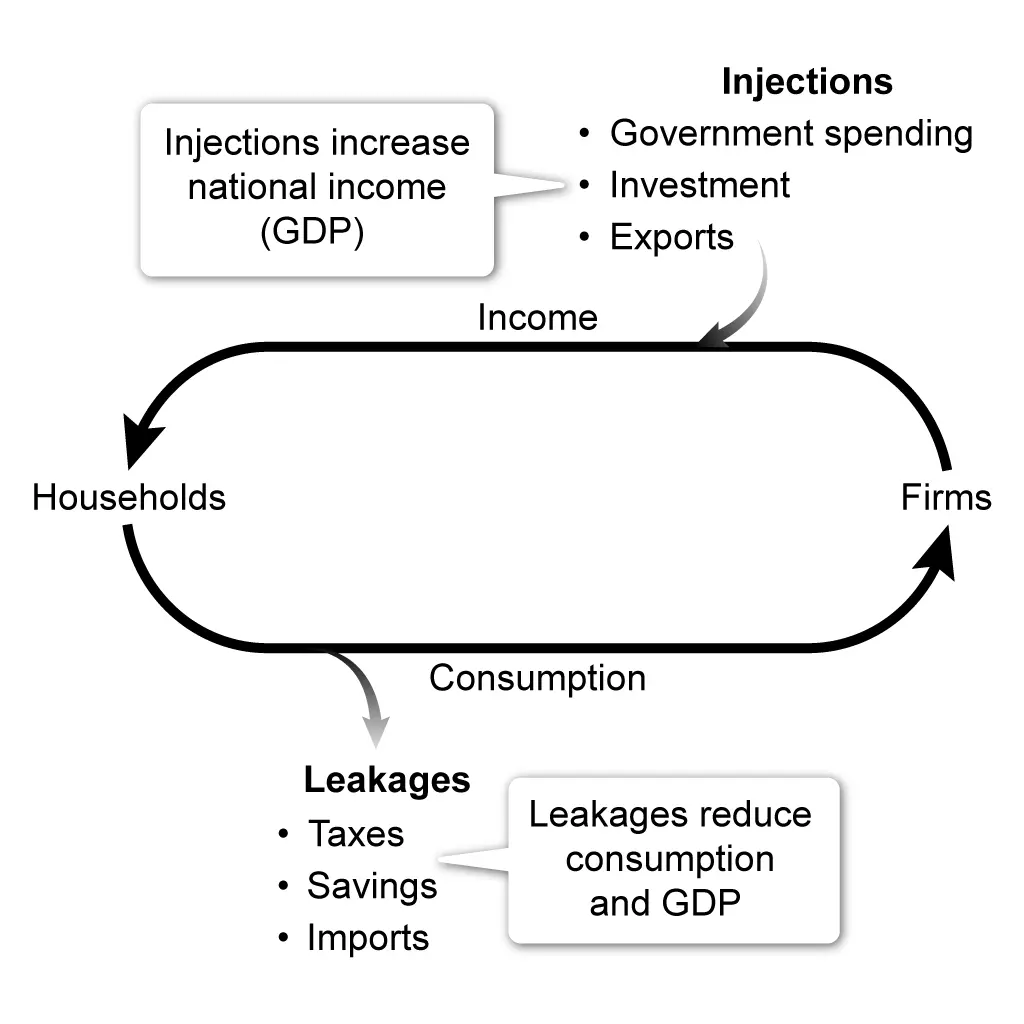

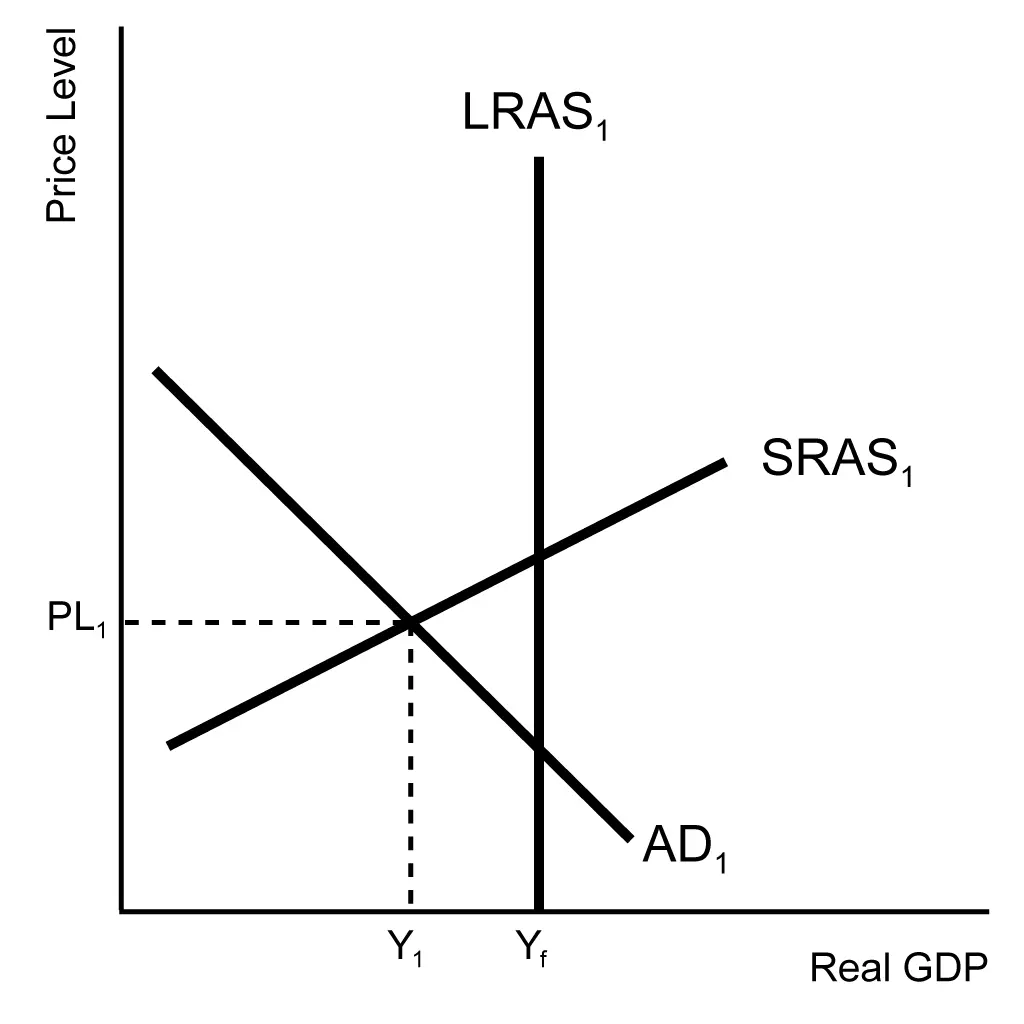

Unit 3: National Income and Price Determination

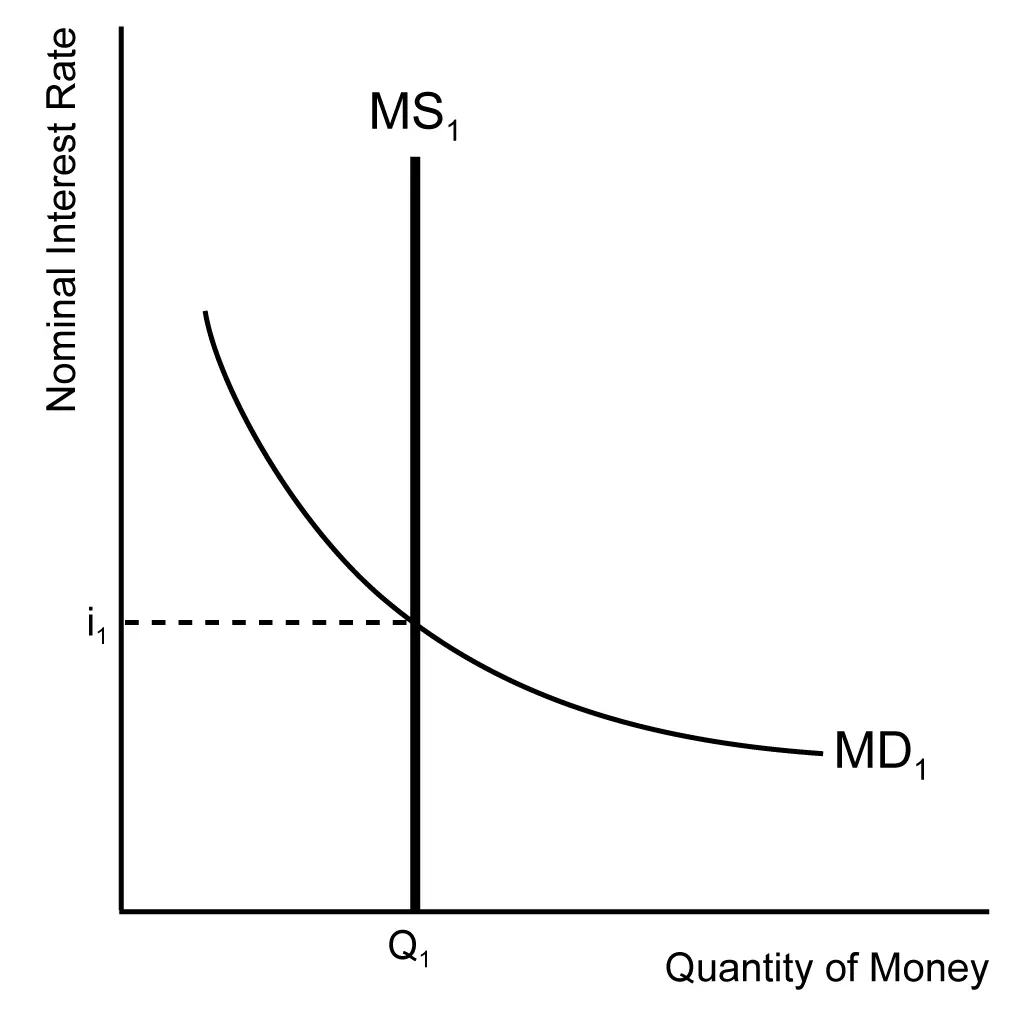

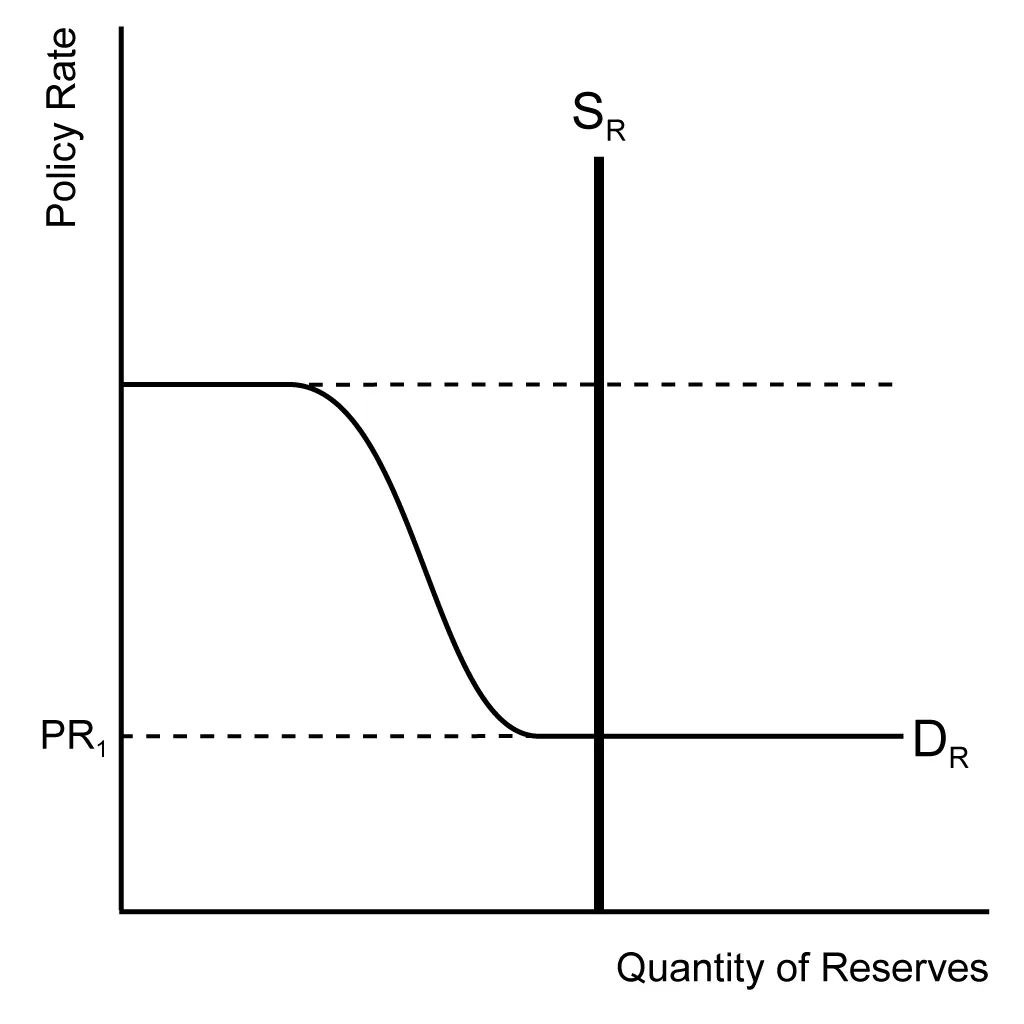

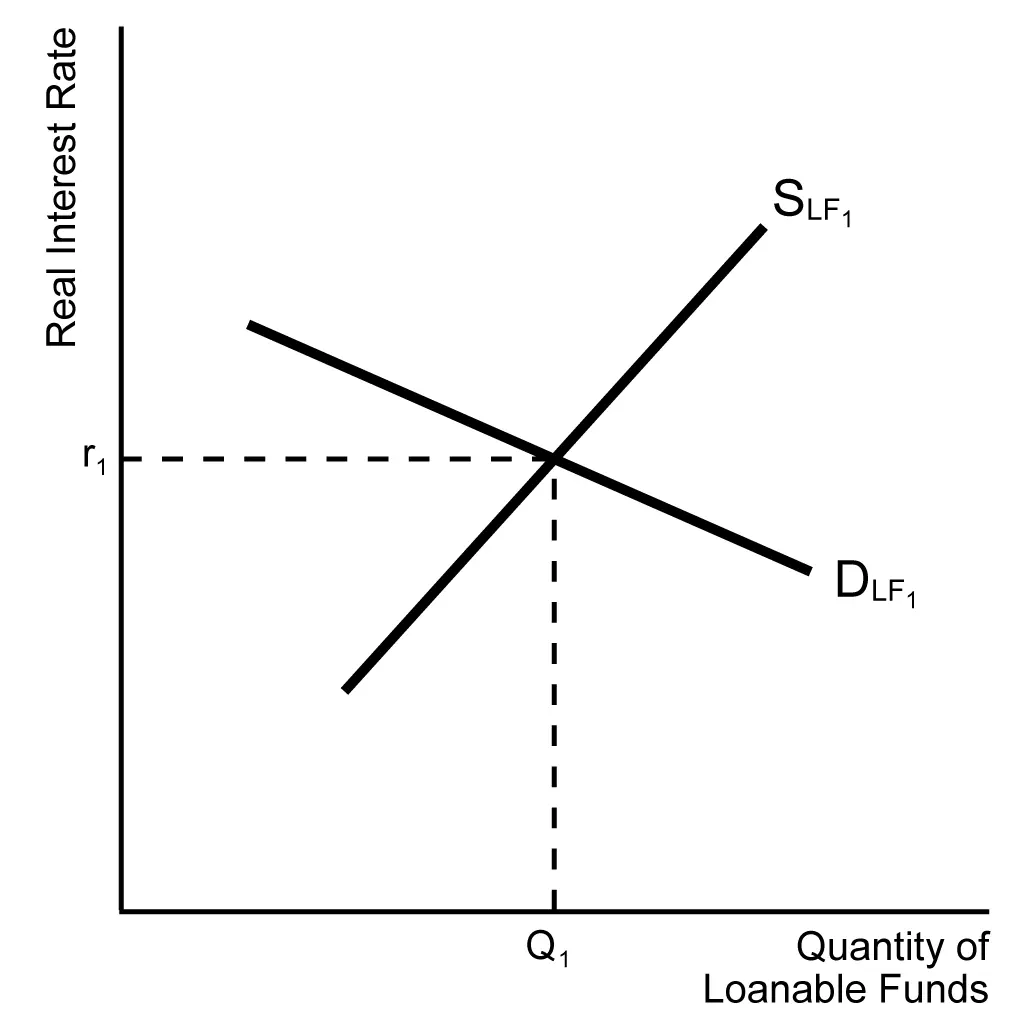

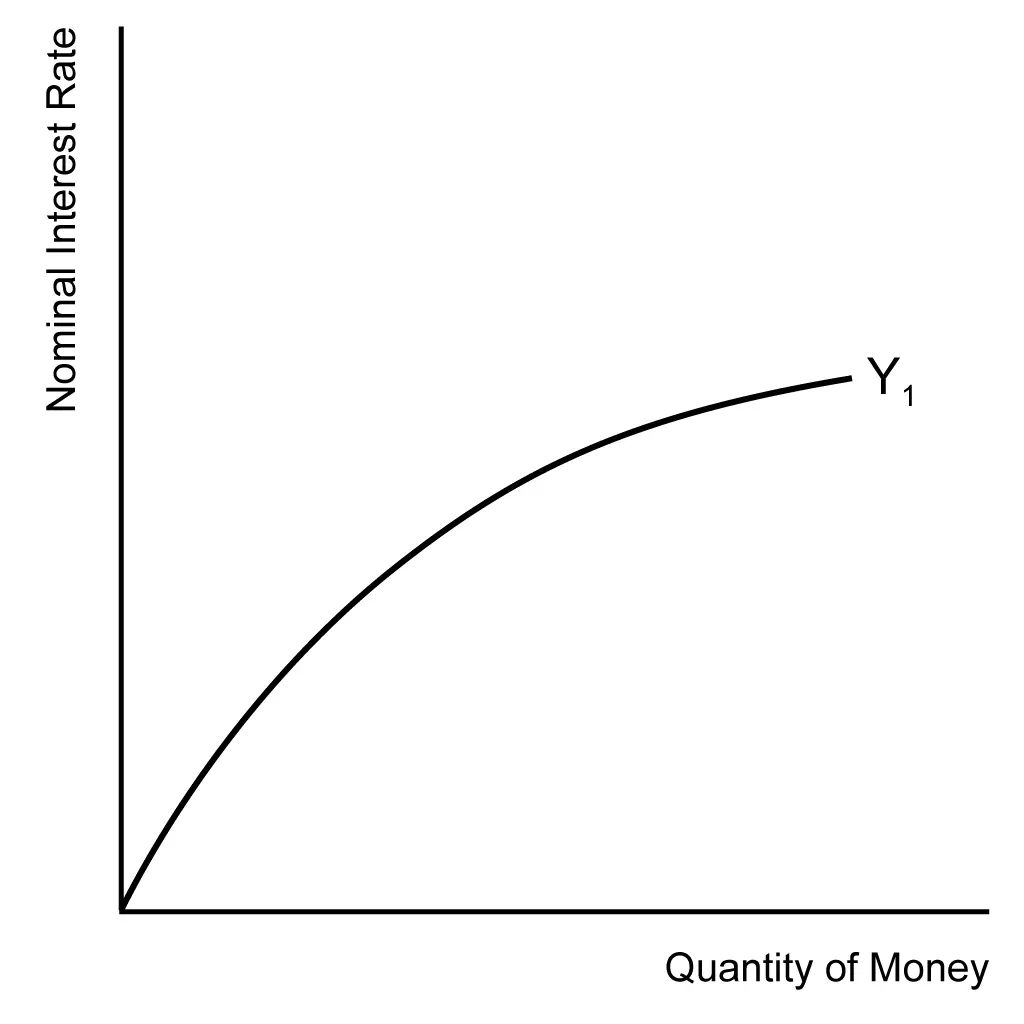

Unit 4: Financial Sector

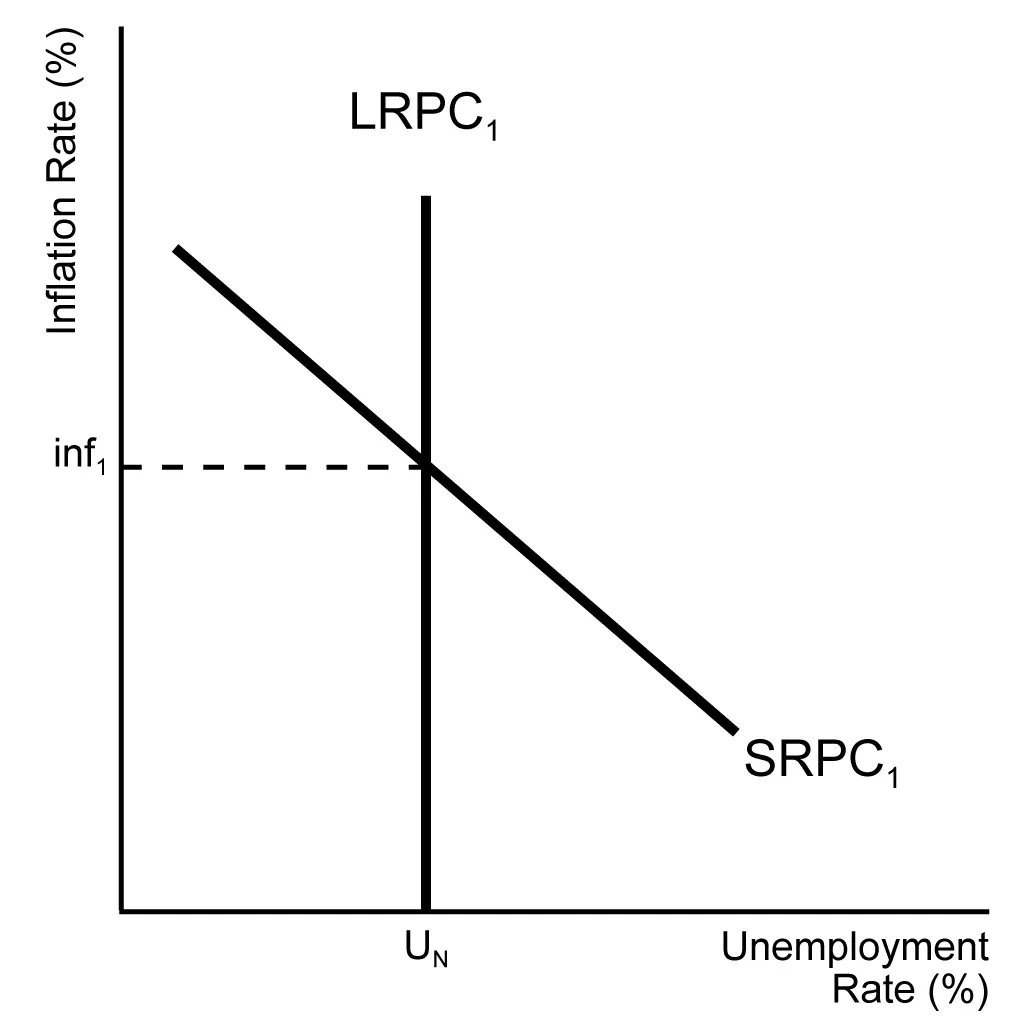

Unit 5: Long-Run Consequences of Stabilization Policies

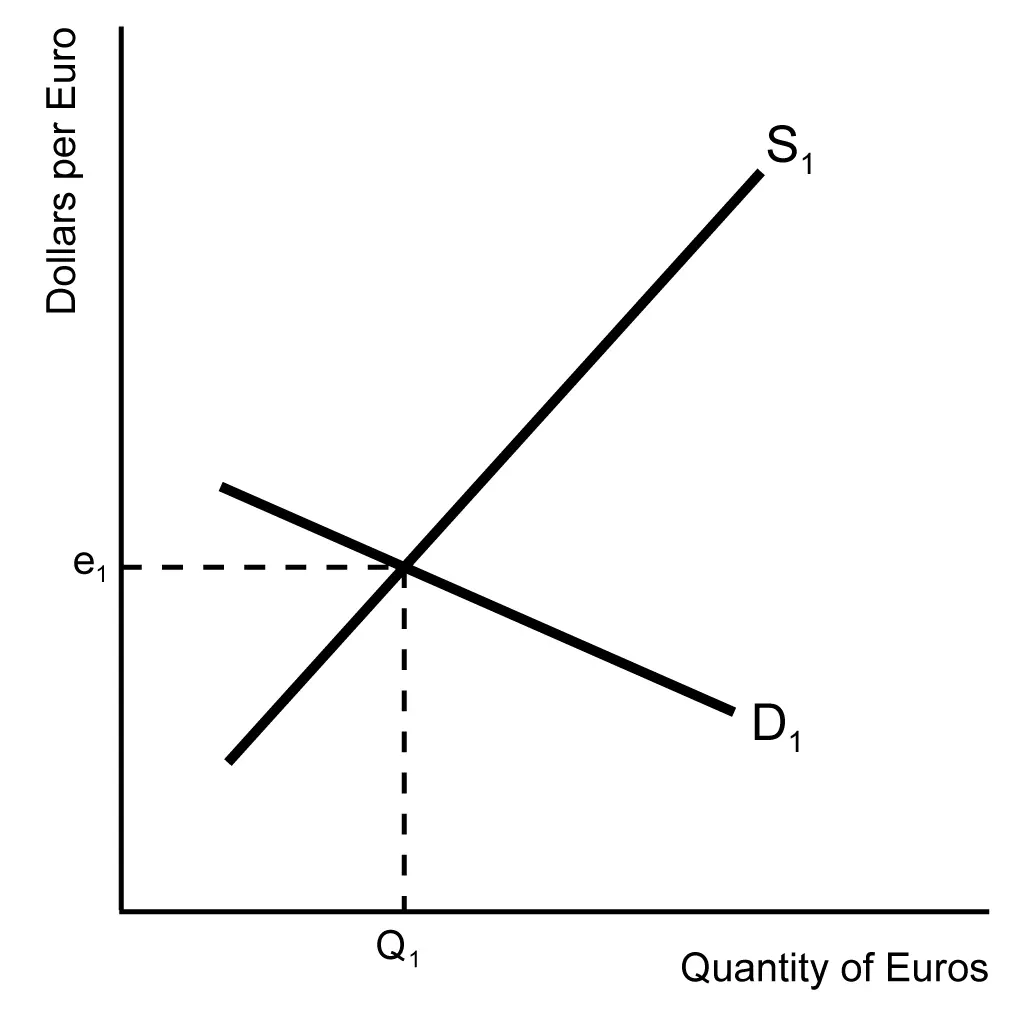

Unit 6: Open Economy—International Trade and Finance

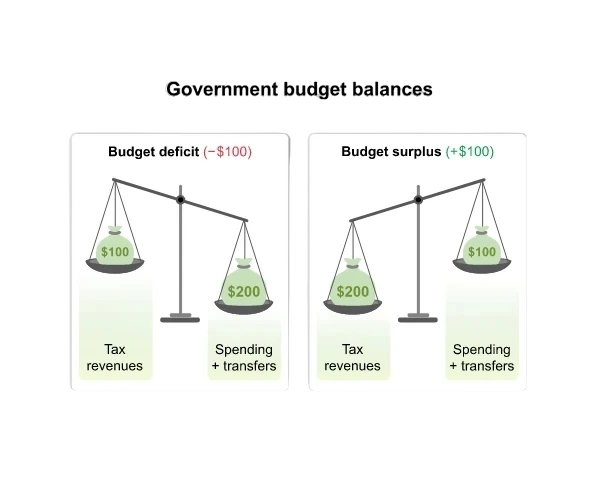

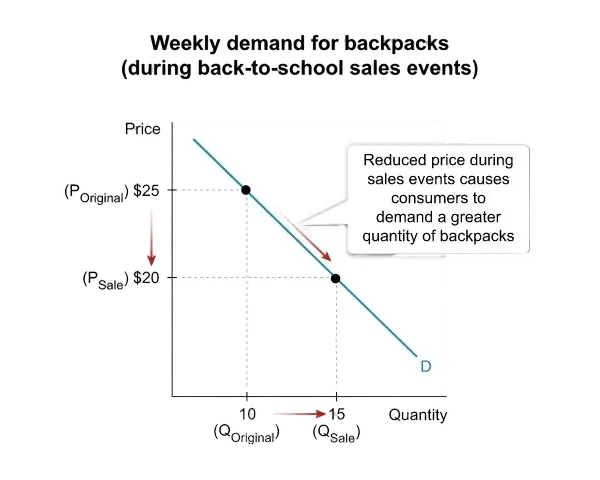

Key AP Macroeconomics Graphs

Memorizing and Applying AP Macroeconomics Formulas

Whether tackling multiple-choice or free-response questions, using the correct formula is essential for solving problems accurately and efficiently. By understanding when and how to apply these ap macro formulas, you’ll be ready to answer complex macroeconomic questions and maximize your score. Let’s explore some expert-recommended tips and strategies to help you master the formulas and excel in the exam.

Frequently Asked Questions (FAQs)

Does AP Macroeconomics involve math?

Yes, AP Macroeconomics involves basic math, such as percentages, graphs, and calculations for concepts such as GDP and inflation.

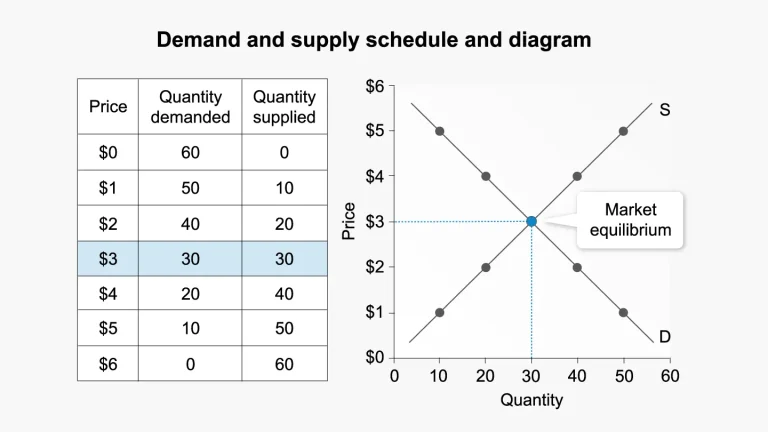

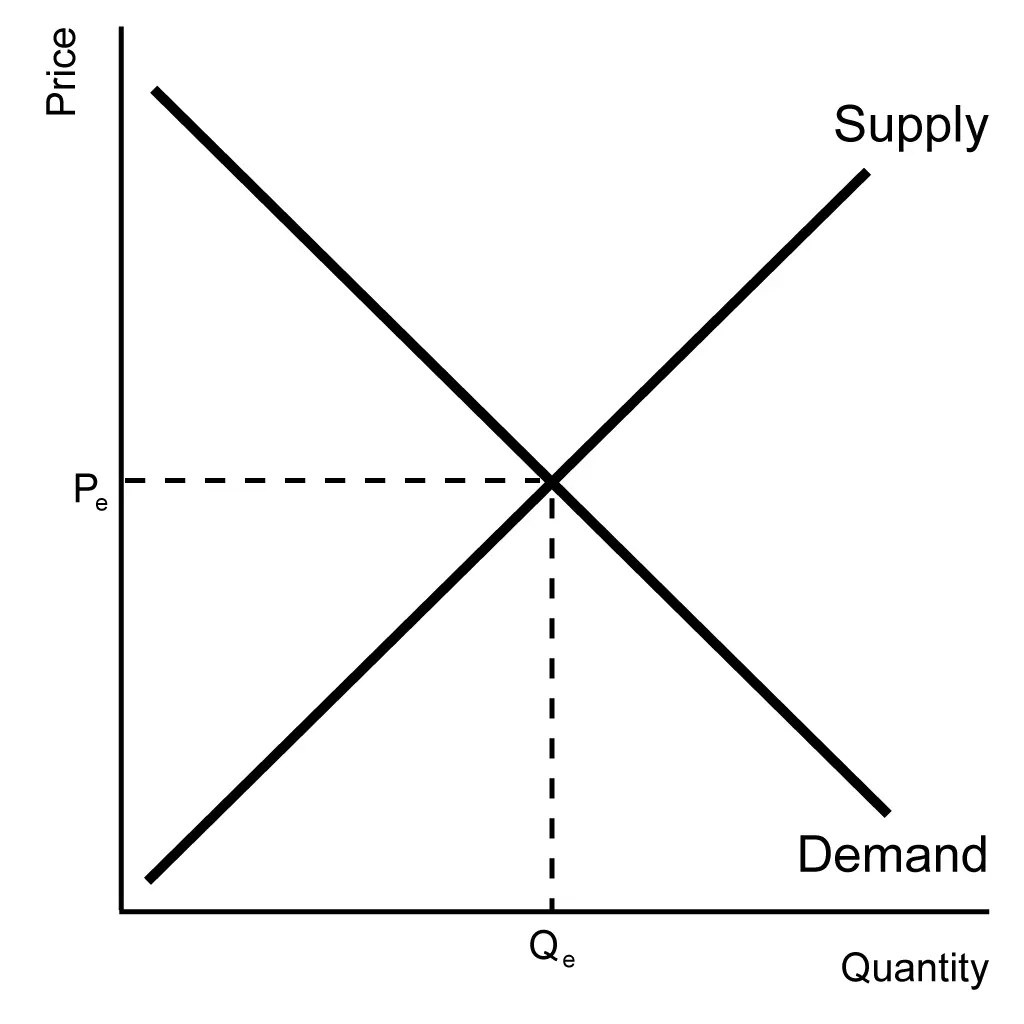

How important are graphs in AP Macroeconomics?

Graphs can help you visualize and understand key macroeconomic concepts like supply, demand, and economic equilibrium.

How can I avoid common mistakes when using AP Macro formulas?

You can avoid common mistakes with AP Macro formulas by understanding the formula units for each component and double-checking the calculations.

Where can I find more practice problems for AP Macroeconomics formulas?

UWorld provides a comprehensive list of practice questions to help you master AP Macroeconomics formulas.

Which AP Macro formulas are the most commonly tested?

The most commonly tested AP Macro formulas are GDP, unemployment rate, inflation rate, and money multiplier.

Can I use logic instead of memorizing every AP Macro formula?

Yes, fully grasping the concepts can help you apply formulas and solve problems without relying on rote memorization.

References

- College Board. (2020). AP Macroeconomics course and exam description. Retrieved from https://apcentral.collegeboard.org/media/pdf/ap-macroeconomics-course-and-exam-description.pdf