Paying for college can be overwhelming, but you don't have to face it alone. While tuition keeps rising, there are resources and financial aid programs designed to help you manage the cost and make your goals more attainable.

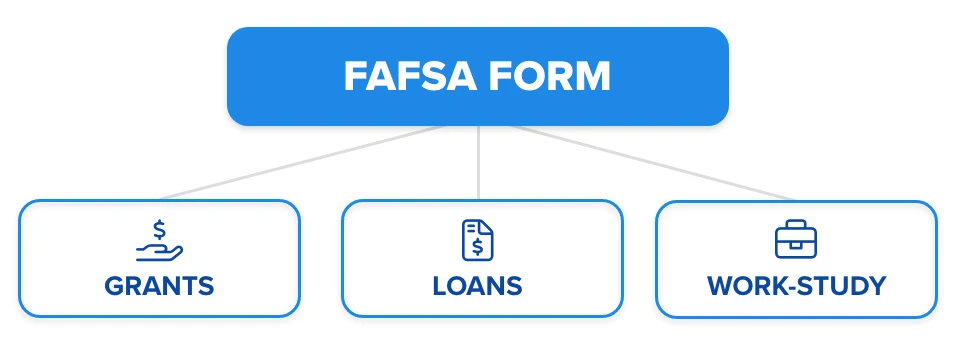

The Free Application for Federal Student Aid (FAFSA®) form is the gateway to grants, scholarships, work-study, and loans that help make tuition, housing, and book costs more manageable. Here's what FAFSA is, who can apply, and how to fill it out.

Why Every Student Should Complete the FAFSA

FAFSA isn't just for students with financial need. Every student should complete the FAFSA form. It's free, simple, and often leads to more aid than you realize. Colleges and states frequently rely on FAFSA results to distribute additional scholarships and grants.

By filling out the FAFSA, you're applying for all 3 of these federal aid types at once:

- Grants: Money you don't have to repay, such as the Pell Grant, awarded primarily based on financial need

- Loans: Borrowed money that must be repaid with interest, but often at lower rates and with more flexible terms than private loans

- Work-Study: Part-time jobs through your school that let you earn money while enrolled

FAFSA Eligibility Requirements

Most students qualify for federal aid, as long as they meet a few basic requirements.1 When you sign up for FAFSA, the information you provide is used to decide which types of aid you qualify for and whether you meet the federal eligibility rules.

You may qualify if you meet these requirements:

- You are a U.S. citizen or eligible noncitizen (such as a permanent resident).

- You are enrolled in or accepted into an eligible degree or certificate program.

- You meet your school's standards for satisfactory academic progress (SAP).

- You are not in default on a federal student loan or owing an overpayment on a federal grant.

How to Check Your Eligibility Status

After you fill out the FAFSA, the following information is automatically reviewed:

- Social Security number (SSN) or Alien Registration number (ARN) to confirm citizenship

- School enrollment status

- Academic progress each year you receive aid

- Federal loan and grant history to confirm you're in good standing

You'll receive a FAFSA Submission Summary (FSS) a few days after submission.2 This report shows what you entered and flags any issues. To view it, log in to your account, open your processed FAFSA, and select “View FAFSA Submission Summary.”

For most students, completing the FAFSA is all you need to do. In certain cases, schools may select you for verification and request documents, such as tax returns or proof of income, to confirm your FAFSA information. If this happens, your school will guide you through the next steps.

FAFSA Eligibility for International Students

Federal student aid is only available to U.S. citizens and eligible noncitizens, which means international students cannot complete the FAFSA. However, many colleges and universities offer scholarships or have separate applications for international financial aid.

If you are studying in the United States on a student visa, check with your school's financial aid office to learn about available options. Exploring these resources with your school's financial aid office can help you identify opportunities to make studying in the U.S. more affordable.

What Determines Your Financial Aid

Once you're eligible, the amount of aid you receive depends on several factors reported on your FAFSA:

- Student Aid Index (SAI): A number calculated from the financial information you and your family provide; schools use it to determine how much aid you may qualify for

- Cost of Attendance (COA): The total estimated cost to attend your school, including tuition, housing, meals, books, transportation, and other expenses

- Year in School: First-year student, sophomore, or further along

- Enrollment Status: Full-time or part-time student

Exact financial aid amounts will depend on your Student Aid Index and your school's costs. Once your FAFSA is processed, each college you listed will send you an offer of financial assistance (often called an award letter).

You'll see a breakdown of the aid type, the amount, and how it will be applied. You can view and compare these offers by logging into your school's financial aid portal or reviewing the letter they sent you.

How and When Aid Is Awarded

Once your FAFSA has been processed, every school you listed will use your information to create its own financial aid offer. That means if you apply to several colleges, you'll receive a separate offer from each one. These offers are typically sent in the spring, around the same time you receive admission decisions.

A financial aid offer, sometimes called an award letter, explains the types of aid you qualify for, the amount awarded in each category, and how and when the funds will be applied. In most cases, your school automatically applies aid to your tuition, housing, and other billed costs.

Your financial aid package, which is the total amount of grants, loans, and work-study listed in your award letter, may sometimes exceed the direct costs billed by your school, like tuition and housing.

When that happens, the extra funds are refunded to you for education-related costs like books, supplies, or transportation. Because timelines and amounts vary by school, review your offers carefully and contact financial aid offices with any questions.

4 Steps to Complete Your FAFSA Form

Before you start, make sure you have the right documents on hand. Having everything ready will save time and help you avoid mistakes. Once you've gathered what you need, 4 straightforward steps on how to apply for FAFSA follow.

FAFSA Checklist

Required for every student applicant:

If you are a dependent student, you'll also need the following from your parent or guardian:

If applicable:

Step 1: Create Your FSA ID

Before you can sign up for FAFSA, you'll need a Federal Student Aid (FSA) ID. This username and password act as your legal signature and give you access to your FAFSA information online. Students and contributors (such as parents or a spouse) must create their own FSA ID. Make sure to keep them separate, since you'll use the same FSA ID every year.

Step 2: Complete the FAFSA Form Online

With your FSA ID ready, you can log in and begin the FAFSA application. The form will guide you through questions in 3 main sections: your personal information, financial information, and details about your parents or spouse if you're a dependent.3

Most income data is pulled directly from the IRS using the Direct Data Exchange (DDX) once you and your contributors give consent, speeding up and improving the process' accuracy.

Remember that federal deadlines run through June 30 of the academic year, but many states and schools have much earlier cutoffs for their own aid. You must resubmit the FAFSA every year to renew your federal aid status.4

While you fill out the form, use the FAFSA financial aid calculator to get an estimate of your federal student aid eligibility. This will help you understand your options to pay for college early so that you can start planning your expenditures.

Step 3: Submit the FAFSA and Review Your FSS

After you complete the FAFSA form, you'll receive a FAFSA Submission Summary (FSS) within a few days. This report shows the information you entered, highlights your Student Aid Index (SAI), and flags any issues. You can view it by logging in to your account, opening your processed FAFSA, and selecting “View FAFSA Submission Summary.”

If you’re selected for verification, don’t panic. It doesn’t mean you did anything wrong. Many students are chosen at random. Just follow the instructions from your school’s financial aid office and provide the requested documents.

Step 4: Review and Compare Your Financial Aid Offers

Once you start receiving each school's financial aid offer, compare them carefully. Look beyond the total dollar amount. Check how much of the package comprises grants or scholarships you don't repay, versus loans that will need repayment later.

Most schools automatically apply aid to your tuition and housing costs, and any leftover funds may be refunded for other expenses like books or transportation. Comparing offers side by side will help you see your real cost at each school.

Frequently Asked Questions (FAQs)

What is FAFSA, and what does it stand for?

FAFSA stands for Free Application for Federal Student Aid. The FAFSA form is the official student financial aid form that determines your eligibility for federal grants, loans, and work-study. In addition to federal student aid, many states and schools also use it to award their own aid.

What types of aid can I get through FAFSA?

Do I have to pay back FAFSA aid?

Regarding federal aid, grants (including Pell Grants), and work-study earnings don’t need to be repaid. Federal student loans must be repaid with interest, though they often offer lower rates and more flexible repayment options than private loans.

How do I apply for FAFSA, and what is an FSA ID?

To apply or sign up for FAFSA, you must create a federal student aid ID at Studentaid.gov, known as an FSA ID. This is your personal login and legal signature. Each person contributing to your college funding/paying for school (e.g., parent or spouse) also needs their own FSA ID before completing the form.

How do I fill out FAFSA step by step, and how long does it take?

The FAFSA form guides you through questions about your personal and financial information. Most data is imported directly from the Internal Revenue Service. Once you have your documents ready, completing the form usually takes less than an hour.

When is the FAFSA due, and how long does FAFSA take to process?

The federal deadline is June 30 each academic year, but many states and colleges set earlier due dates for the FAFSA. After you submit FAFSA, the processing time usually takes a few days, though it may take longer during peak periods.

How can I estimate my FAFSA aid amount?

You can use the official FAFSA Student Aid Estimator, also known as the FAFSA estimate calculator, to see an early projection of your eligibility and how much aid you may receive. Results are based on your Student Aid Index (SAI), which replaced the Expected Family Contribution (EFC) starting in 2024–25.6

How do I add or change schools on my FAFSA?

Log in to your StudentAid.gov account, open your FAFSA form, and select the option to add or update schools. You can send your FAFSA to up to 20 colleges at a time.

How can I view or update my FAFSA information later?

After submission, you’ll receive a FAFSA Submission Summary. You can log back in to view your info, make corrections, or update your FAFSA if your circumstances change.

Where do I go if I need help with FAFSA?

For official guidance, student aid support, or the FAFSA phone number, visit StudentAid.gov or call the Federal Student Aid Information Center. You can also contact your school’s financial aid office for personalized support. Search for “Student Financial Aid Office” or “Office of Student Financial Aid” on your school’s website to find the right contact for financial assistance.

References

- Federal Student Aid. (2021, June 17). Removal of selective service and drug-conviction requirements for Title IV eligibility. U.S. Department of Education. https://fsapartners.ed.gov/knowledge-center/library/federal-registers/2021-06-17/removal-selective-service-and-drug-conviction-requirements-title-iv-eligibility

- Federal Student Aid. (n.d.). Contributor's Social Security Number. U.S. Department of Education. https://studentaid.gov/announcements-events/fafsa-support/contributor-social-security-number

- Federal Student Aid. (n.d.). Filling out the FAFSA form. U.S. Department of Education. https://studentaid.gov/apply-for-aid/fafsa/filling-out

- Federal Student Aid. (n.d.). FAFSA deadlines. U.S. Department of Education. https://studentaid.gov/apply-for-aid/fafsa/fafsa-deadlines

- Federal Student Aid. (2025, August 15). 2026-27 FAFSA form and Pell Grant eligibility updates. U.S. Department of Education. https://fsapartners.ed.gov/knowledge-center/library/electronic-announcements/2025-08-15/2026-27-fafsa-form-and-pell-grant-eligibility-updates

- Federal Student Aid. (n.d.). What is the EFC (Expected Family Contribution)? U.S. Department of Education. https://studentaid.gov/help-center/answers/article/what-is-efc