AP® Macroeconomics Unit 6 Review and Practice Test

AP® Macroeconomics Unit 6 shifts from the domestic economy to the global one. You learn how currencies gain and lose value, how international flows react to interest rate changes, and how trade balances connect to capital movement. These ideas can feel abstract at first, but UWorld turns them into clear, step-by-step reasoning, making your AP Macroeconomics Unit 6 review easier, not more complicated.

Make AP Macroeconomics Unit 6 Easier With Guided Review Tools

Unit 6 introduces new models and vocabulary, but the underlying logic remains consistent: when conditions change, money flows across borders, and currencies adjust accordingly. UWorld helps you see these relationships clearly, connecting interest rates to capital movement and exchange rates to net exports. With guided walkthroughs, the open economy becomes far more predictable.

Engaging Video Lessons That Simplify Unit 6

These lessons demonstrate how the supply and demand for currencies shift in response to changes in interest rates, how appreciation and depreciation impact exports and imports, and how capital flows adjust to global economic fluctuations. Instead of memorizing terms, you learn to interpret each graph and scenario visually. This makes the foreign exchange market and balance of payments far easier to master.

Interactive Study Guides That Breakdown Complex Topics

These guides help you understand the balance of payments structure, exchange rate determinants, the distinction between real and nominal exchange rates, and how global financial flows adjust when economic conditions change. You learn the reasoning behind every movement, so your AP Macroeconomics Unit 6 study guide work becomes more intuitive and less memorization-heavy.

Prepare Faster With Unit 6 Practice Test Questions That Reflect Real Exam Patterns

Question

| Year | Euros per US dollar at beginning of year | Euros per US dollar at end of year |

|---|---|---|

| 2005 | €0.75 | €0.81 |

| 2010 | €0.88 | €0.82 |

| 2015 | €0.85 | €0.86 |

| 2020 | €1.00 | €0.94 |

| 2023 | €1.03 | €0.98 |

According to the data above, in which year did the United States dollar depreciate the most relative to the euro?

| A. 2005 | |

| B. 2010 | |

| C. 2015 | |

| D. 2020 | |

| E. 2023 |

Explanation:

| Year | Euros per US dollar at beginning of year | Euros per US dollar at end of year |

|---|---|---|

| 2005 | €0.75 | €0.81 |

| 2010 | €0.88 | €0.82 |

| 2015 | €0.85 | €0.86 |

| 2020 | €1.00 | €0.94 |

| 2023 | €1.03 | €0.98 |

In the foreign exchange market, the exchange rate is the price of one currency in terms of another. In the table, the price of each US dollar in terms of euros was €0.75 at the beginning of 2005. By the end of 2005, euro holders paid more euros—€0.81—per dollar, meaning the dollar appreciated.

When the price of a dollar in terms of euros rises, as it did in 2005 and 2015, the dollar appreciates, not depreciates—eliminate Choices A and C.

Likewise, the dollar depreciates when its price falls. In 2010, the exchange rate fell from €0.88 per dollar to €0.82 per dollar, a decrease of €0.06—depreciating approximately 6.8%.

Percent change = Euros per dollar after − Euros per dollar before

Euros per dollar before × 100

Following the equation above, the percentages by which the dollar depreciated in 2020 and 2023 are:

| 2020 | ((€0.94 − €1.00) / €1.00) × 100 = −6% |

| 2023 | ((€0.98 − €1.03) / €1.03) × 100 = −4.9% |

Because the dollar depreciated more in 2010 (6.8%) than in 2020 (6%) and 2023 (4.9%), eliminate Choices D and E.

Things to remember:

A currency depreciates when its value in terms of another currency falls.

Question

If Norway's central bank increases its administered rates, which of the following will most likely occur?

| A. Norway's capital inflow will decrease | |

| B. Norway's export revenue will decrease | |

| C. Norway's private investment in plant and equipment will increase | |

| D. Norway's domestic consumption will increase | |

| E. Norway's budget will move toward a surplus |

Explanation:

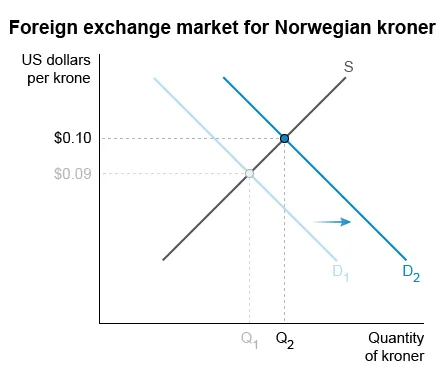

An increase in Norway's central bank's administered rates increases the interest rate on Norwegian interest-bearing assets. Foreign investors then purchase more Norwegian assets, raising demand (D1 to D2) for the Norwegian krone—which then appreciates—in the foreign exchange market.

The appreciation of the krone increases Norwegian export prices in terms of foreign currencies, resulting in foreign buyers purchasing fewer Norwegian goods and services. Therefore, Norwegian export revenue decreases. When Norway's central bank raises its administered rates, Norway's exports become more expensive and export revenue decreases.

|

|

When the krone appreciates, the price of Norwegian exports increases in other countries. Norwegian exporters' revenue decreases because the quantity sold decreases, but the revenue received per unit—in kroner—does not change. |

An increase in administered rates by Norway's central bank is a contractionary monetary policy. Raising administered rates will increase domestic interest rates, and as a result:

- (Choice A) foreign investors will buy more kroner to purchase Norwegian interest-bearing assets, which will increase, not decrease, Norway's capital inflow.

- (Choices C and D) the cost of borrowing will increase, which will decrease Norwegians' private investment in plant and equipment and domestic consumption.

(Choice E) Raising administered rates will decrease aggregate demand and output. All else equal, tax revenue will fall, moving Norway's budget toward deficit, not surplus.

Things to remember:

Raising interest rates causes a currency to appreciate, increasing the cost of exports for foreign buyers. As a result, export revenue will fall, and net exports will decrease.

Question

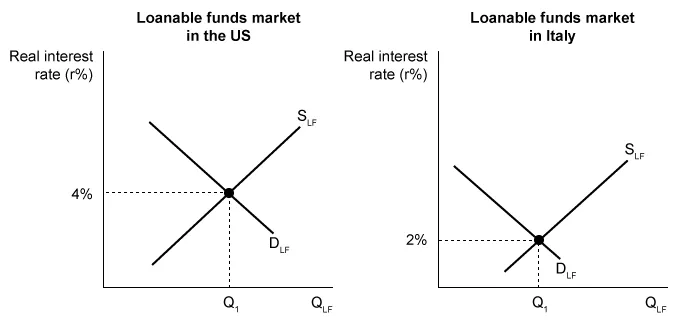

Using the graphs above, which of the following correctly identifies what will happen to financial capital flows between the United States and Italy?

| A. Financial capital will flow out of the United States and into Italy. | |

| B. Financial capital will flow into both the United States and Italy. | |

| C. Financial capital will flow out of Italy and into the United States. | |

| D. Financial capital flows will not change. |

Explanation:

Financial capital flows toward the country with the higher real interest rate. People who have money saved in Italy will take their money out of Italy and put it into the US to earn a higher return on their investment (savings). Therefore, financial capital will flow out of Italy and into the US.

Stand Out

with a Top Score on the AP Macroeconomics Exam

Finish your AP Macroeconomics Unit 6 review and continue mastering all units with UWorld. Boost your performance and stand out as a top candidate for competitive colleges, majors, and scholarships by earning a top score.

Get our all-in-one course today!

- Focused AP Macro Videos

- Print & Digital Study Guide

- 200+ Exam-style Practice Questions

- Customizable Quiz Generator

- Adjustable Study Planner

- Realistic Timed Test Simulation

- Colorful Visual Explanations

- Progress Dashboard

- Smart Flashcards & Digital Notebook

Hear From Our AP Students

UWorld’s service is pretty good and helps provide a lot of explanations on subjects I haven’t been confident on before.

The questions here are the most realistic to the AP tests I've seen so far! I appreciate the ability to customize tests as well.

The best part is that all options are well-explained, telling clearly why they are not the right option.

Frequently Asked Questions (FAQs)

What are the main topics covered in AP Macroeconomics Unit 6: Open Economy—International Trade and Finance?

AP Macroeconomics Unit 6 introduces you to how economies interact globally. Instead of focusing only on domestic inflation, output, or unemployment, you learn how currencies gain or lose value, why capital flows across borders, and how changes in interest rates affect trade balances. Students often find Unit 6 more conceptual because it blends supply and demand logic with international finance. UWorld helps simplify this by breaking every AP Macroeconomics Unit 6 model into small, visual steps that make the global system easier to interpret.

Unit 6 typically includes:

- Balance of payments accounts

- Exchange rates and the foreign exchange market

- Effects of changes in policies and economic conditions on the foreign exchange market

- Changes in the foreign exchange market and net exports

- Real interest rates and international capital flows

Once you understand the logic behind how money flows and why currencies shift, Unit 6 becomes far more predictable. Most questions follow a clear sequence: interest rates change, capital moves, the currency responds, and net exports adjust. Seeing this chain clearly is what makes Unit 6 manageable and helps you master the AP Macroeconomics Unit 6 review efficiently.

How should I prepare for an AP Macroeconomics Unit 6 exam?

Unit 6 requires you to interpret how global markets react when economic variables shift. The best preparation focuses on learning these sequences rather than memorizing isolated facts. Students who struggle typically skip steps or misinterpret what causes appreciation or depreciation. UWorld’s AP Macro Unit 6 practice test questions are helpful because the explanations walk you through each step: interest rates change, capital flows adjust, and then currency supply and demand respond.

To prepare effectively:

- Redraw the foreign exchange market multiple times until shifts feel intuitive

- Review the balance of payments structure: current account vs financial account

- Practice determining whether a currency appreciates or depreciates

- Work through interest rate scenarios involving capital inflow and outflow

- Learn how currency changes affect net exports and aggregate demand

- Compare open-economy effects of fiscal and monetary policies

- Review AP Macro unit 6 MCQ samples to strengthen pattern recognition

Once you can walk through every step of a scenario without hesitation, the unit becomes much easier. Nearly every AP question relies on the same core logic: interest rates drive financial flows, financial flows drive exchange rates, and exchange rates drive net exports. Master that sequence, and Unit 6 becomes one of the most predictable parts of the course.

Are any free resources available for AP Macroeconomics Unit 6?

Yes, several free resources can support your AP Macroeconomics Unit 6 review, and each one offers a different type of value. A strong starting point is UWorld’s free 7-day trial, which includes AP Macroeconomics unit 6 practice test questions and detailed explanations that walk you through foreign exchange markets, capital flows, and balance of payments adjustments. AP Classroom provides Unit 6 topic questions and the official Unit 6 progress check, helping you test your understanding of how currencies respond to economic shocks.

Many teachers publish foreign exchange worksheets, balance of payments charts, and capital flow summaries through Google Classroom or Canvas. Online videos can also be helpful, but their quality varies, especially regarding how appreciation and depreciation affect net exports. Free notes and cheat sheets are available on teacher sites, but they often summarize the concepts without showing the sequence of events the AP exam expects you to explain. The best strategy is to combine free materials with a reasoning-focused resource, such as UWorld, which not only shows you how the models shift but also explains why the shifts occur. This combination reinforces the logic behind Unit 6 and prepares you more thoroughly for MCQs and FRQs.

What types of questions are on the AP Macroeconomics Unit 6 test?

Unit 6 questions focus heavily on how exchange rates and international flows react to economic changes. Many items test your ability to read the foreign exchange market, analyze capital movement, and connect interest rate differences to currency appreciation or depreciation. Students often struggle because they try to answer too quickly without identifying the first market affected. UWorld’s AP Macroeconomics Unit 6 MCQ sets help because they show how AP questions subtly embed these sequences.

You’ll typically see questions involving:

- Shifts in currency demand and supply based on interest rate changes

- Appreciation and depreciation effects on exports and imports

- Balance of payments entries: current account vs financial account

- Capital inflow and outflow in response to global rate differences

- How fiscal or monetary policy affects exchange rates indirectly

- Real vs nominal exchange rate interpretation

- Loanable funds connections to foreign investment

- Graph identification, especially ap macro unit 6 graphs involving currency markets

Once you train yourself to identify the starting market and move step by step through the sequence, Unit 6 questions become predictable. The AP exam repeats the same patterns: rates change, capital moves, currency adjusts, and net exports shift. Mastering this chain is the key to scoring higher.

How can I improve my score on the Free-Response Questions (FRQs) for Unit 6?

Unit 6 FRQs require precision. You must clearly explain the entire flow of events: what causes the shock, how capital responds, what happens to the currency, and how net exports adjust. Many students lose points by skipping steps or mixing up which curve shifts. UWorld’s AP Macro Unit 6 FRQ-style explanations help because they break down every shock into a clean, logical sequence.

To strengthen your FRQ work:

- Start by identifying whether the initial change affects interest rates or trade flows

- Redraw the foreign exchange market before answering

- Specify which curve shifts and why

- Track capital flow direction: inflow vs outflow

- Connect currency movements to net exports, not directly to GDP

- Use arrows to show appreciation or depreciation steps

- Label current account and financial account changes accurately

- Recheck long-run vs short-run reasoning when relevant

Once you practice tracing these sequences, FRQs stop feeling unpredictable. The graders reward students who write clearly and logically, not those who try to memorize buzzwords. Understanding the flow is what earns points.

What is the "Open Economy—International Trade and Finance" unit's weight on the AP Macroeconomics exam?

Unit 6 accounts for 10-13% on the AP Macroeconomics exam, and consistently appears in both the multiple-choice and FRQ sections because open-economy reasoning directly connects to earlier units. Questions involving exchange rates, net exports, capital flows, and interest rate differences frequently appear, often under the broader categories of aggregate demand, monetary policy, or financial markets. This means Unit 6 concepts usually appear even when the question isn’t explicitly labeled as an AP Macro Unit 6 problem. The AP exam also tends to include at least 1 FRQ or FRQ-part involving appreciation or depreciation, balance of payments entries, or capital movement.

As global flows respond to changes in interest rates, Unit 6 knowledge overlaps with monetary policy and loanable funds, making it indirectly tested throughout the exam. The AP Macro Unit 6 MCQ closely reflects these patterns, highlighting the exam’s emphasis on exchange rate logic. Mastering Unit 6 strengthens your performance across the entire test because the cause-and-effect chains used in this unit mirror the reasoning found in fiscal policy, monetary policy, and AD–AS analysis. In short, Unit 6 is a high-leverage unit even without a strict percentage because it teaches the global linkages behind many AP-level scenarios.

Where can I find a good study guide for AP Macroeconomics Unit 6?

A strong Unit 6 study guide should do more than list definitions. It should help you understand how global financial flows and currency markets respond to changes in interest rates, trade patterns, and policy decisions. Many students struggle with the sequencing behind exchange rate movements, so a good guide must walk you through each step. UWorld is a dependable starting point because its AP Macro Unit 6 study guide content breaks down each model visually and explains why every shift occurs.

You can find reliable Unit 6 study guides in:

- UWorld’s structured, step-by-step explanations of exchange rate graphs

- AP Classroom’s Unit 6 overview and topic summaries

- Teacher-created packets covering balance of payments and foreign exchange practice

- Review books that include sample open-economy scenarios

- High-quality online notes from AP Macro instructors

- Classroom slide decks explaining interest rate–driven capital flows

- Worksheets that combine numerical examples with conceptual diagrams

A helpful study guide connects multiple markets. Unit 6 combines foreign exchange, balance of payments, and interest rate logic, so your guide must help you understand how one shock propagates across the system. If the guide you use explains these relationships clearly, it will make the entire unit far less confusing.

Can I find practice tests specifically for AP Macro Unit 6?

Yes, you can find Unit 6-specific practice tests from multiple reliable sources. These practice sets are essential because Unit 6 questions often require several steps of reasoning: interest rates change, capital flows adjust, currencies move, and net exports respond. A strong practice set helps you internalize this sequence. UWorld’s AP Macroeconomics Unit 6 practice test questions are particularly useful because they simulate the exact logic patterns found on the AP exam.

You can find Unit 6 practice tests through:

- UWorld’s QBank, which includes scenario-based currency and capital flow questions

- AP Classroom’s Unit 6 Progress Check MCQ and topic questions

- Teacher-generated tests covering foreign exchange and balance of payments

- Review books that offer dedicated open-economy practice sections

- Instructor websites with full-length AP Macro practice sets

- Classroom materials combining open-economy and monetary policy scenarios

Practicing with these sources strengthens your ability to process multi-step problems. The more you expose yourself to repeated patterns, the easier it becomes to diagnose whether a question starts with a change in interest rates, trade flows, or foreign investment. Once you see the structure, the unit becomes predictable.

How can I prepare for the AP Macro Unit 6 progress check in AP Classroom?

Preparing for the AP Macro Unit 6 progress check requires mastering how different markets interact with one another. Begin by reviewing the foreign exchange model and practicing how demand and supply shift in response to changes in domestic or foreign interest rates. Next, revisit the balance of payments to understand how current and financial account entries move in opposite directions. Work through interest rate scenarios, especially those involving capital inflow or outflow, because these often appear on the AP Macroeconomics Unit 6 progress check MCQ. After that, practice identifying appreciation or depreciation and explaining its effect on net exports.

It’s also important to connect Unit 6 logic to earlier content; for example, changes in monetary policy affect interest rates, which in turn influence capital flows and currency values. Once you feel comfortable with the sequences, complete the progress check slowly and focus on recognizing where each question begins. After finishing, review every missed question carefully, labeling whether the mistake came from misreading the shock, misunderstanding the capital flow direction, or forgetting how currency movements affect trade. UWorld’s explanations help reinforce the structure behind each scenario, making the next set of questions easier to decode. With this approach, the progress check becomes more manageable because you learn to view each shock as part of a predictable chain.

What are the most common mistakes students make in AP Macro Unit 6?

Most Unit 6 errors occur because students skip directly to currency shifts without first identifying the market affected. Currency values don’t move randomly; they react to changes in interest rates, trade flows, or capital movement. Many students also confuse the balance of payments categories, particularly when distinguishing between capital inflows and changes in the current account. UWorld helps prevent these errors because its explanations show each link in the chain, strengthening your AP Macro Unit 6 review accuracy.

Common mistakes include:

- Forgetting that interest rate differences drive capital flow, not trade preferences

- Confusing currency appreciation with “getting stronger in value” but ignoring net export effects

- Misclassifying BOP entries, especially mixing current and financial account transactions

- Drawing both supply and demand shifts when only one should move

- Assuming a trade deficit is always “bad” rather than understanding its connection to capital inflow

- Ignoring that currencies move because foreign investors demand or supply assets

- Forgetting that appreciation makes exports more expensive and imports cheaper

- Not recognizing when the shock starts abroad rather than domestically

When you learn to pause and identify the shock correctly, these mistakes drop quickly. Unit 6 becomes much easier once you treat each change as part of a predictable system rather than isolated facts.

How can I study effectively for AP Macroeconomics Unit 6 MCQs?

Unit 6 MCQs usually involve following a clear economic sequence, and studying effectively means practicing that sequence repeatedly. If you try to jump straight to the currency response without identifying the initial condition, you’ll miss the logic behind the question. MCQs often start with interest rate differences, capital flow changes, or shifts in global demand for assets. UWorld’s AP Macroeconomics Unit 6 MCQ explanations help because they show you exactly how to trace each step instead of treating the models as disconnected.

To study MCQs effectively:

- Start every question by identifying whether the shock affects interest rates, trade flows, or investor behavior

- Redraw the foreign exchange market frequently so that supply and demand shifts become instinctive

- Work through practice sets that mix U.S. shocks with foreign shocks

- Review how appreciation and depreciation affect net exports and aggregate demand

- Practice balance of payments entries until you can classify transactions immediately

- Solve mixed Unit 6 problem sets under timed conditions

- Use mistake logs to isolate whether your errors come from graph interpretation or a misunderstanding of flows

With sufficient practice, the logic becomes automatic: capital inflow leads to appreciation, appreciation reduces exports, and net exports impact aggregate demand. Once this chain feels natural, MCQs become much easier and more predictable.

Can I study AP Macroeconomics Unit 6 offline if I need to?

Yes, Unit 6 is very easy to study offline because most of the essential skills involve tracing flows and drawing graphs rather than relying on digital tools. You can practice appreciation and depreciation by sketching the foreign exchange market and labeling the direction of each shift. You can also review capital inflow and outflow by writing out scenarios and tracking which country’s currency becomes more or less demanded. Many students find that redrawing the balance of payments structure by hand helps them remember which transactions belong in the current account versus the financial account.

UWorld mobile app supports offline study by allowing you to download AP Macro Unit 6 practice test questions, so you can continue practicing without an internet connection and sync your progress later. Offline study is also useful for mastering complex sequences, such as how changes in interest rates trigger capital movement, which in turn affects exchange rates. Writing out these chains repeatedly strengthens understanding in ways that passive online review cannot. When combined with periodic online explanation to verify your reasoning, offline practice becomes one of the most effective ways to master Unit 6’s open-economy logic.