AP® Macroeconomics Unit 5 Review and Practice Test

AP® Macroeconomics Unit 5 brings together everything you learned about inflation, unemployment, fiscal policy, monetary policy, and the Phillips Curve. UWorld helps you understand these concepts clearly, so your AP Macro Unit 5 review feels manageable, not overwhelming.

Start AP Macroeconomics Unit 5 Confidently With Tools That Clarify Stabilization Policies

Unit 5 explores the most complex cause-and-effect relationships in macroeconomics. You learn how fiscal and monetary policies influence inflation, unemployment, interest rates, and real output. UWorld’s AP Macro Unit 5 review organizes these moving parts into simple, visual explanations that help you see exactly how policy actions shift key models.

Engaging Video Lessons That Breakdown Policy Effects

These short lessons explain how fiscal and monetary tools operate, why their impacts differ in the short run and the long run, and how those effects are represented on graphs such as the AD-AS and Phillips Curve. Visual examples show how certain policies lower unemployment but raise inflation, while others slow inflation but may increase unemployment. You learn to recognize the logic behind each policy tool, rather than memorizing isolated facts.

Interactive Study Guides That Connect Complex Policies

These guides walk you through the structure of Unit 5 models in a step-by-step manner. You see how expansionary and contractionary policies shift curves, how crowding out works, how expectations adjust, and how long-run outcomes differ from immediate short-run changes. The explanations help you understand why the economy cannot achieve every goal simultaneously and how choices create trade-offs. This makes your AP Macroeconomic Unit 5 study guide easier to work with.

Master AP Macro Unit 5 Skills With Practice Sets That Mirror Exam Logic

Question

A supply-side fiscal policy action to increase economic growth would be to increase which of the following?

| A. Government funding for research and development | |

| B. Government purchases of domestically produced goods and services | |

| C. Government payments to unemployed workers | |

| D. Tax rates on business profits | |

| E. Regulations on energy production |

Explanation:

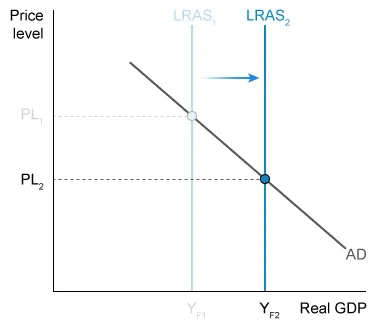

Economic growth occurs when an economy's real output per capita increases over time. The aggregate demand–aggregate supply model shows growth as a rightward shift of long-run aggregate supply (LRAS). LRAS corresponds to an economy's full-employment level of output, or potential output (YF).

A government aiming to increase LRAS can fund research and development projects to create new technologies, such as faster computers that boost productivity. A government promotes economic growth by increasing the economy's technological capabilities.

(Choices B and C) Government purchases of domestic output and payments to unemployed workers increase aggregate demand in the short run. However, long-run adjustment means economic growth does not necessarily result from those actions.

Actions disincentivizing production by reducing firms' profits—discouraging economic growth—include:

- (Choice D) increasing taxes on business profits.

- (Choice E) increasing energy regulations, likely increasing firms' costs.

Things to remember:

Government policies that encourage the development of new technologies increase potential output, creating economic growth.

Question

A government budget surplus occurs when

| A. income tax rates decrease | |

| B. consumption plus investment exceeds government spending | |

| C. changes in government borrowing result in crowding out | |

| D. government spending plus transfer payments are less than tax revenues | |

| E. a government has fully satisfied its debt obligations |

Explanation:

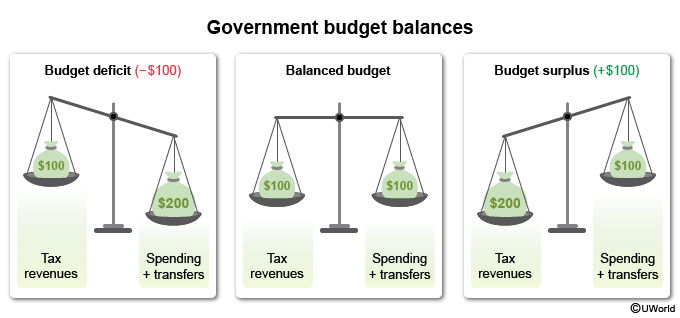

A government's budget is balanced when tax revenues equal its spending, which includes transfer payments. A budget surplus results when the value of government spending is less than the value of tax revenues.

For example, a government that collects $200 in tax revenues and spends $100 on purchases and transfer payments experiences a budget surplus of $100.

|

|

Modern governments don't usually have budget surpluses. According to the CIA World Factbook, only about one in five countries had a budget surplus in 2017. |

(Choice A) A government's budget balance can't be determined without knowing the value of its spending.

(Choice B) The relative values of government spending and tax revenues, not consumption plus investment, determine a budget surplus.

(Choice C) Crowding out results from increased government borrowing, which is unlikely when a government has a budget surplus.

(Choice E) National debt accumulates on an ongoing basis, but government budgets apply to only the current fiscal year. Therefore, a government can have a current budget surplus despite having outstanding debts.

Things to remember:

A budget surplus results when government spending, including transfer payments, is less than tax revenues.

Question

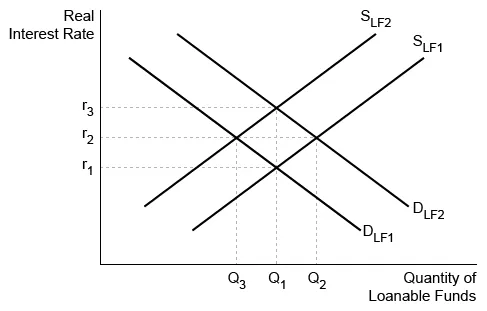

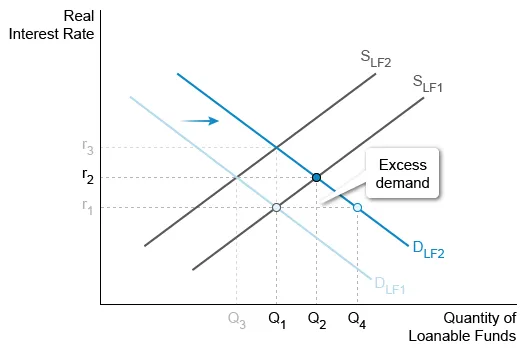

Based on the graph of the loanable funds market above, crowding out occurs when government borrowing causes a change from

| A. SLF2 to SLF1 | |

| B. DLF1 to DLF2 | |

| C. DLF2 to DLF1 | |

| D. Q1 to Q3 | |

| E. Q2 to Q1 |

Hint:

Crowding out occurs when interest rates increase.

Explanation:

To fulfill its financial obligations when running a budget deficit, a government must borrow—shifting demand (DLF1 to DLF2)—in the loanable funds market. This shift creates excess demand (Q4 − Q1) at the initial real interest rate, r1, causing the equilibrium interest rate to rise (r1 to r2).

As the interest rate rises, the quantity of loanable funds borrowed for private investment decreases. This short-run effect is called crowding out. Thus, increased government borrowing increases the demand for loanable funds, causing interest rates to rise and crowding out to occur.

Crowding out does not result from a decrease in interest rates, which can be illustrated by:

- (Choice A) a rightward shift of the supply curve for loanable funds (SLF2 to SLF1).

- (Choice C) a leftward shift of DLF (DLF2 to DLF1).

(Choices D and E) Crowding out refers to the effect of increased interest rates on private investment, not the total quantity of loanable funds supplied and demanded.

Things to remember:

Increased government borrowing increases the interest rate and crowds out private investment in the short run.

Stand Out

with a Top Score on the AP Macroeconomics Exam

Finish your AP Macroeconomics Unit 5 review and continue mastering all units with UWorld. Boost your performance and stand out as a top candidate for competitive colleges, majors, and scholarships by earning a top score.

Get our all-in-one course today!

- Focused AP Macro Videos

- Print & Digital Study Guide

- 200+ Exam-style Practice Questions

- Customizable Quiz Generator

- Adjustable Study Planner

- Realistic Timed Test Simulation

- Colorful Visual Explanations

- Progress Dashboard

- Smart Flashcards & Digital Notebook

Hear From Our AP Students

UWorld’s service is pretty good and helps provide a lot of explanations on subjects I haven’t been confident on before.

The questions here are the most realistic to the AP tests I've seen so far! I appreciate the ability to customize tests as well.

The best part is that all options are well-explained, telling clearly why they are not the right option.

Frequently Asked Questions (FAQs)

What are the main topics covered in AP Macroeconomics Unit 5: Long-Run Consequences of Stabilization Policies?

AP Macroeconomics Unit 5 integrates price levels, unemployment, policy tools, and expectations into a unified, interconnected framework. This unit forces you to consider trade-offs, because the economy cannot achieve both low inflation and low unemployment simultaneously in every scenario. The AP exam expects you to understand not only how policies shift curves, but also why some policies lose effectiveness over time. UWorld helps simplify these interactions so your AP Macroeconomics Unit 5 review feels structured instead of chaotic.

Unit 5 typically includes:

- The Phillips Curve

- Money growth and inflation

- Government deficits and national debt

- Crowding out

- Economic growth

When you understand how each tool affects inflation and unemployment, Unit 5 becomes far easier. Most questions are cause-and-effect chains that follow predictable patterns. Once the relationships click visually, the rest of the unit feels logical and almost formulaic.

How should I prepare for an AP Macroeconomics Unit 5 exam?

Unit 5 questions require both conceptual clarity and model fluency. Memorizing definitions won’t help if you can’t visualize how inflation or unemployment responds to specific policy actions. You need to be comfortable moving between AD–AS shifts, Phillips Curve adjustments, and crowding out logic. UWorld’s AP Macroeconomics Unit 5 practice sets are helpful because the explanations walk you through the entire reasoning chain step by step.

A strong Unit 5 study approach includes:

- Redrawing AD-AS and both Phillips Curves repeatedly until movement patterns are automatic

- Practicing fiscal vs monetary policy effects in both the short run and long run

- Reviewing how crowding out works through interest rates and investment changes

- Learning how expected inflation changes shift the Phillips Curve

- Comparing policy speed, effectiveness, and limitations

- Solving FRQ-style prompts that walk through a full policy sequence

- Reviewing mistakes to identify whether you misread a curve shift or misinterpreted inflation changes

Once you can explain why a policy does what it does, not just what shifts, the unit becomes much more predictable. Unit 5 rewards students who understand the mechanisms behind the models, rather than those who merely memorize isolated facts.

Are any free resources available for AP Macroeconomics Unit 5?

Yes, you can access several free resources to support your AP Macroeconomics Unit 5 preparation, and each provides a different type of value. A practical starting point is UWorld’s free 7-day trial, which allows you to explore detailed explanations and AP Macroeconomics Unit 5 practice test questions that break down the effects of fiscal and monetary policy, the Phillips Curve, and crowding out. AP Classroom offers official Unit 5 topic questions and the Unit 5 Progress Check, which is extremely close in structure to the real exam and helps you identify whether your understanding of policy tradeoffs is consistent across question types.

Many teachers upload graph packets, stabilization policy worksheets, and FRQ practice sets on platforms like Google Classroom or Canvas. You can also find supplementary videos online, but their quality varies significantly, especially in terms of long-run versus short-run curve movements and expected inflation adjustments. While free resources are excellent for reinforcing core ideas, they rarely offer the depth of reasoning needed for high-level FRQs. Combining free tools with a reasoning-based resource like UWorld gives you both conceptual grounding and detailed feedback, which is essential for mastering Unit 5’s policy-heavy content.

What types of questions are on the AP Macroeconomics Unit 5 test?

Unit 5 questions focus heavily on cause and effect. Most items ask you to analyze how a policy choice affects inflation, unemployment, interest rates, or output in both the short run and long run. Instead of memorizing curve names, you must understand the sequence behind each shift. This is what makes the AP Macro unit 5 MCQ section feel different from earlier units; every question tests your ability to read a chain reaction correctly. UWorld prepares you for this by providing scenarios that require you to track changes across AD–AS, the Phillips Curve, and the loanable funds market.

Common Unit 5 question types include:

- Identifying how expansionary or contractionary policies shift AD

- Reading Phillips Curve adjustments after demand shocks or supply shocks

- Recognizing how expected inflation shifts the short-run Phillips Curve

- Crowding-out scenarios involving interest rate changes and investment effects

- Long-run adjustments that return the economy to natural unemployment

- Policy timing and lag-based questions

- Cost-push vs demand-pull inflation analysis

- FRQs requiring multiple linked steps from policy to inflation to unemployment

Once you see the structure behind these question types, Unit 5 becomes predictable. Every policy question follows the same logic: identify the policy, determine the market affected first, trace the resulting shifts, and compare short-run vs long-run outcomes.

How can I improve my score on the Free-Response Questions (FRQs) for Unit 5?

Unit 5 FRQs reward students who can clearly explain the sequence of events triggered by a policy decision. Most responses fail not because students misunderstand the concept, but because they skip steps or mix up short-run and long-run outcomes. UWorld helps you avoid this by breaking each AP Macro Unit 5 FRQ into a chain of reasoning rather than a set of isolated answers.

To maximize your FRQ performance:

- Always begin by identifying whether the question involves the short run or the long run

- Write out each curve shift explicitly rather than assuming it’s obvious

- Keep AD-AS, Phillips Curve, and loanable funds graphs separate in your mind

- Explain why interest rates rise or fall before connecting to investment or inflation

- Use arrows or labels to track each step in the policy sequence

- Compare outcomes with the natural rate of unemployment whenever relevant

- Practice FRQs that involve multiple markets or multiple time horizons

The more you walk through these sequences, the more intuitive they become. When you can narrate the logic without hesitation, FRQs shift from complicated to predictable.

What is the "Long-Run Consequences of Stabilization Policies" unit's weight on the AP Macroeconomics exam?

Unit 5 consistently plays a major role on the AP Macroeconomics exam, weighing 20-30% of the exam score because it connects fiscal policy, monetary policy, and macroeconomic outcomes. Every released exam includes several multiple-choice questions rooted in Unit 5 logic, particularly those involving Phillips Curve adjustments, policy effectiveness, and trade-offs between short-run and long-run inflation and unemployment. Additionally, one FRQ almost always tests Unit 5 concepts directly or indirectly. Even when a question appears to focus on another unit, the underlying reasoning often depends on stabilization policy outcomes or inflation expectations, which come from Unit 5.

The AP Macroeconomics Unit 5 progress check MCQ also mirrors many exam patterns, making it a good predictor of what you’ll see on test day. Unit 5 forces students to juggle multiple models simultaneously; mastering it strengthens their understanding across the entire course. Topics such as crowding out, interest rate changes, and price level adjustments recur in monetary policy, long-run growth, and aggregate demand analysis. For this reason, Unit 5 often feels like one of the most heavily weighted sections, even if the official distribution remains broad. Students who develop strong Unit 5 reasoning typically experience higher overall exam confidence because they can decode policy questions regardless of the scenario.

Where can I find a good study guide for AP Macroeconomics Unit 5?

If you want a dependable Unit 5 study guide, your best resources will be those that clearly explain policy chains instead of merely listing definitions. This unit explores the interaction between fiscal and monetary policies and their impact on inflation, unemployment, and expectations, so you need a guide that walks you through cause-and-effect sequences. UWorld is a strong starting point because its explanations break stabilization policies into small steps that match the logic required on FRQs during your AP Macroeconomics Unit 5 study guide review.

Good places to find Unit 5 study guides include:

- UWorld’s interactive guides with AD-AS and Phillips Curve walkthroughs

- AP Classroom Unit 5 topic summaries and released practice questions

- Teacher-created packets that include policy sequences and graph templates

- Review books that provide sample shocks and long-run adjustments

- Classroom notes focusing on crowding out, inflation expectations, and SR vs LR

The key is choosing a guide that illustrates how one change leads to another. If the resource helps you track the path from a policy decision to inflation, unemployment, and output, then it will prepare you well for this understanding. The more clearly you see these chains, the easier Unit 5 becomes.

Can I find practice tests specifically for AP Macro Unit 5?

Yes, there are several reliable sources for Unit 5-specific practice tests, and using them is critical because this unit is highly scenario-driven. Strong practice should force you to analyze policy shocks, trace curve movements, and predict inflation-unemployment outcomes. UWorld’s AP Macroeconomics Unit 5 practice test problems prepare you for this because they mirror the logic and pacing of actual AP exam questions.

You can find Unit 5 practice tests in:

- UWorld’s AP Macro QBank, which includes realistic policy-based MCQs

- AP Classroom’s Unit 5 Progress Check MCQ and associated topic questions

- Teacher-made tests focusing on fiscal policy, monetary policy, and Phillips Curve shifts

- AP review books offering dedicated Unit 5 practice sections

- Online instructor resources that provide crowding out and expectations practice

- Classroom worksheets that mix AD-AS and Phillips Curve problems

Working across these formats exposes you to the full variety of shocks tested on the exam. The more practice you complete, the easier it becomes to recognize patterns. After a few sets, the logic of Unit 5’s policy interactions becomes predictable.

How can I prepare for the AP Macro Unit 5 progress check in AP Classroom?

To prepare effectively for the Unit 5 progress check, focus on mastering the logic behind how stabilization policies affect inflation and unemployment. The progress check often presents scenarios in which the government or central bank takes action, and you must determine how those decisions influence AD-AS, interest rates, or the Phillips Curve. Begin by practicing the sequence: Expansionary fiscal policy raises aggregate demand, increases output, lowers unemployment, and tends to raise inflation in the short term. From there, review how expected inflation shifts the short-run Phillips Curve and why the long-run Phillips Curve remains vertical at the natural rate of unemployment.

Trace crowding out carefully: higher government spending raises interest rates, which reduces private investment. Then work through several AP Macroeconomics Unit 5 progress check MCQ items so you can practice scanning graphs and interpreting curve movements correctly. As you review each mistake, label whether it resulted from misunderstanding a policy tool, confusing short-run with long-run effects, or misreading expected inflation changes. UWorld’s explanations help reinforce these patterns by walking through each step visually. With enough repetition, the progress check will feel far more manageable because the underlying structure becomes familiar.

What are the most common mistakes students make in AP Macro Unit 5?

Most Unit 5 errors occur because students rush to apply policy tools without thinking through the sequence of effects. This unit is all about chains of logic: policy, interest rates, spending, inflation, unemployment, and long-run adjustment. Missing even one link leads to incorrect answers. The AP exam expects you to know the entire chain, not just the first step. UWorld helps reduce these errors because each explanation forces you to trace every shift and outcome, thereby improving your accuracy in AP Macroeconomics Unit 5 review.

Typical Unit 5 mistakes include:

- Confusing short-run and long-run Phillips Curve behavior

- Forgetting that expected inflation changes shift the SRPC

- Misinterpreting crowding out, especially the role of interest rates

- Mixing up demand-pull vs cost-push inflation origins

- Assuming fiscal and monetary policies have equal speed or effectiveness

- Drawing AS shifts when the question describes an AD-driven change

- Forgetting that the LRPC is vertical at the natural unemployment rate

- Skipping the long-run adjustment that restores output to potential

Once you slow down and track each step carefully, these errors drop quickly. The more you practice the sequences, the more predictable the questions become. Unit 5 rewards clear, patient reasoning much more than memorization.

How can I study effectively for AP Macroeconomics Unit 5 MCQs?

Unit 5 MCQs test your ability to track policy chains quickly and accurately. Most questions present a brief scenario describing a fiscal or monetary action, and you must determine the impact on output, inflation, unemployment, or interest rates. Many students struggle because they jump straight to curve shifts without identifying the first market affected. Effective MCQ preparation involves slowing down enough to determine the starting point and then moving through the sequence one step at a time. UWorld supports this because its AP Macro Unit 5 MCQ sets show why each distractor fails, helping you see exactly where logic breaks down.

To study effectively:

- Identify whether the scenario refers to fiscal or monetary policy before doing anything else

- Redraw AD–AS and the Phillips Curve so you can visualize short-run vs long-run outcomes

- Practice tracing interest rate changes through investment and output

- Review crowding-out problems and the loanable funds market

- Learn how supply shocks affect inflation and unemployment differently

- Watch for expected inflation changes, which shift the SRPC

- Time yourself on mixed problem sets to build pacing

Once you train yourself to move through these chains consistently, MCQs become far easier. The AP exam repeats the same logic patterns, so mastery comes from recognizing those patterns quickly.

Can I study AP Macroeconomics Unit 5 offline if needed?

Yes, Unit 5 is very accessible offline because most of the reasoning comes from drawing graphs, labeling shifts, and walking through policy sequences step by step. You can practice almost everything by sketching the AD-AS model, both Phillips Curves, and the loanable funds market on paper. Working offline is especially useful for building confidence with long-run versus short-run adjustments because repeatedly drawing the same curves forces your brain to internalize the correct movement patterns. You can also create your own scenarios, such as “The central bank decreases the money supply,” and then draw the entire chain from interest rates to unemployment.

UWorld supports offline study by letting you download AP Macroeconomics Unit 5 practice test questions, so even without internet access, you can work through realistic policy scenarios and check your reasoning once you reconnect. This combination of offline graph practice and online explanations helps you learn the logic behind each policy tool, rather than memorizing shifts. Unit 5 rewards students who can think through sequences without relying on technology.