AP® Macroeconomics Unit 4 Review and Practice Test

AP® Macro Unit 4 covers everything from how banks create money to how interest rates shape the economy. This guide breaks down the Financial Sector in a simple, clear way so you can use it for your Unit 4 AP Macro review, practice MCQ progress check questions, and prepare for the AP Macro Unit 4 FRQ on exam day.

Your Go-To AP Macroeconomics Unit 4 Study Guide for the Exam

Mastering AP® Macroeconomics Unit 4 doesn't have to feel overwhelming. We walk you through the money market, interest rates, and monetary policy using visuals and examples built for real students. Whether you're reviewing for your AP Macro Unit 4 test or refreshing notes for your next class, this unit-focused review makes everything easier.

Engaging Video Lessons

Our video lessons explain the trickiest Unit 4 topics, including the money multiplier, loanable funds market, and how the Federal Reserve uses monetary policy tools. These short clips make concepts like shifting money market curves or reading AP Macro Unit 4 graphs feel way more doable.

Interactive Study Guides

Our AP Macro Unit 4 study guide gives you visuals, step-by-step breakdowns, and quick summaries to help you learn faster. You’ll cover everything from required graph analysis to understanding key terms for AP Macroeconomics Unit 4 practice tests.

Sharpen Your Skills with These AP Macro Unit 4 Practice Questions

Question

Which of the following will cause an increase in the quantity of money demanded?

| A. Decreasing nominal interest rates | |

| B. Decreasing prices in the economy | |

| C. Decreasing real national output | |

| D. Increasing real interest rates | |

| E. Increasing unemployment |

Explanation:

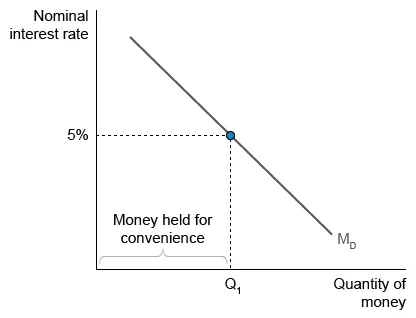

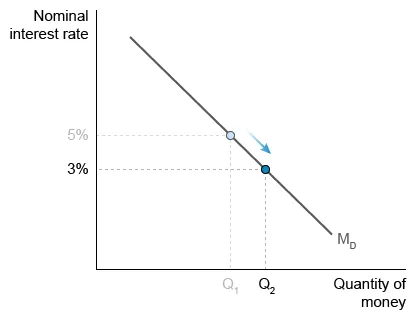

The money demand curve (MD) illustrates the tradeoff faced when choosing which assets to own. Money is liquid, meaning consumers can easily use money for transactions. But inflation erodes buying power, so savers prefer to hold their wealth in assets that pay more interest. However, assets with higher interest rates are less liquid, and thus less convenient, than money.

The interest rate is the opportunity cost of holding money. For example, if the interest rate is 5%, the quantity of money demanded—the amount held for convenience—is Q1. Money exceeding Q1 will not be held but instead used to purchase more interest-earning assets.

However, when the nominal interest rate falls, the opportunity cost of holding money falls, and the quantity of money demanded increases (Q1 to Q2).

(Choices B, C, and E) When MD shifts leftward, the quantity of money demanded at every nominal interest rate decreases, not increases. MD shifts leftward when:

- prices fall and people need less money to make purchases.

- output falls, unemployment rises, and people make fewer purchases because their incomes decrease.

(Choice D) The real interest rate rises when nominal interest rates increase or inflation decreases, both of which will cause the quantity of money demanded to decrease, not increase.

Things to remember:

There is an inverse relationship between the nominal interest rate and the quantity of money people want to hold.

Question

In a limited-reserves banking system, which of the following is true about a contractionary monetary policy?

| A. It increases the supply of reserves | |

| B. It increases the money multiplier | |

| C. It decreases the quantity of money demanded | |

| D. It decreases the federal funds rate | |

| E. It decreases the equilibrium nominal interest rate |

Explanation:

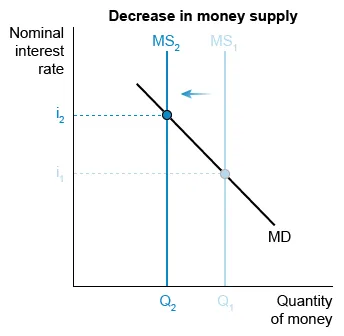

In a limited-reserves banking system, the central bank implements contractionary monetary policy through actions that decrease the money supply (MS).

Following the leftward shift from MS1 to MS2, MS intersects the money demand (MD) curve at a higher nominal interest rate in the money market.

When the nominal interest rate increases, the opportunity cost of holding money rather than investing it in interest-earning assets increases, so less money is demanded. The MD curve's negative slope on the graph above illustrates the inverse relationship between the nominal interest rate and the quantity of money demanded.

Contractionary monetary policy thus raises interest rates and decreases the quantity of money demanded.

The federal funds rate the US interbank lending rate is the policy rate by which the Federal Reserve influences most other interest rates.

(Choices A, D, and E) Contractionary monetary policy decreases, rather than increases, reserves, causing the federal funds rate and the equilibrium nominal interest rate to increase, not decrease.

(Choice B) Contractionary monetary policies, such as increasing the required reserve ratio, decrease, rather than increase, the money multiplier because they discourage bank lending.

Things to remember:

The money demand curve shows that people demand a lower quantity of money when the nominal interest rate increases.

Question

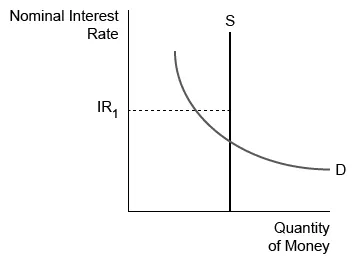

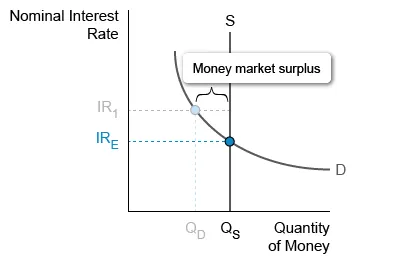

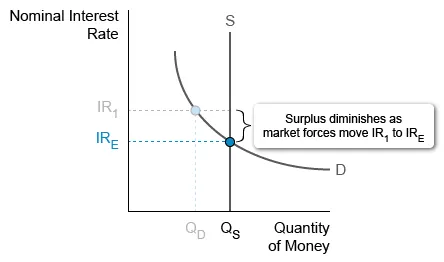

Assume IR1 represents the current nominal interest rate in the money market. It can be concluded that

| A. there is currently a shortage of money | |

| B. money demand will increase to achieve equilibrium | |

| C. investors will buy short-term assets with interest rates below IR1 | |

| D. the quantity of money demanded equals the quantity of money supplied | |

| E. those holding money will expect the inflation rate to be less than IR1 |

Explanation:

When the nominal interest rate (IR1) is above the equilibrium rate (IRE), the quantity of money supplied (QS) exceeds the quantity demanded (QD), creating a money market surplus. The opportunity cost for people holding this surplus of money is the interest they could earn by investing in short-term interest-bearing assets such as bonds.

As people holding money buy assets, sellers lower their nominal interest rates while still attracting buyers. Investors seeking gains from interest continue purchasing assets even when the nominal interest rate decreases below IR1.

However, as the interest rate decreases, assets become less attractive to investors—the opportunity cost of holding money falls as people increasingly prefer spending over investing. The quantity of money demanded increases as people forego investing, and the money market moves toward equilibrium at IRE, diminishing the surplus.

(Choices A and D) At IR1, the quantity of money supplied exceeds the quantity demanded, representing a surplus, not a shortage.

(Choice B) Money demand will not increase unless a determinant of money demand, such as the price level, changes.

(Choice E) There isn't enough information to determine the inflationary expectations of people holding money.

Things to remember:

Market forces eliminate a money surplus because a decreasing nominal interest rate reduces the opportunity cost of holding money.

Study Anywhere, Anytime

Studying for AP Macro Unit 4 is easier when everything is in one place. With the UWorld app, you can work through a Unit 4 AP Macro practice test, check your understanding of the Financial Sector, or review mistakes from earlier progress checks. Whether you’re waiting for class or hanging out at a coffee shop, you can always fit in a quick review.

Stand Out

with a Top Score on the AP Macroeconomics Exam

Finish your AP Macroeconomics Unit 4 review and continue mastering all units with UWorld. Boost your performance and stand out as a top candidate for competitive colleges, majors, and scholarships by earning a top score.

Get our all-in-one course today!

- Focused AP Macro Videos

- Print & Digital Study Guide

- 200+ Exam-style Practice Questions

- Customizable Quiz Generator

- Adjustable Study Planner

- Realistic Timed Test Simulation

- Colorful Visual Explanations

- Progress Dashboard

- Smart Flashcards & Digital Notebook

Hear From Our AP Students

UWorld’s service is pretty good and helps provide a lot of explanations on subjects I haven’t been confident on before.

The questions here are the most realistic to the AP tests I've seen so far! I appreciate the ability to customize tests as well.

The best part is that all options are well-explained, telling clearly why they are not the right option.

Frequently Asked Questions (FAQs)

What are the main topics covered in AP Macroeconomics Unit 4: Financial Sector?

AP Macroeconomics Unit 4 focuses on the Financial Sector and introduces the concepts that explain how money moves through the economy. The unit includes four core areas: financial assets, the definition and functions of money, how money is measured, the banking system, and how monetary policy works. UWorld presents these topics using clear explanations and simple visuals so you can understand how each part fits together, especially when preparing for AP Macro Unit 4 practice questions or progress check MCQs.

The main topics you’ll study in Unit 4 include:

- Financial assets (like stocks, bonds, and interest rates)

- Definition, measurement, and functions of money (M1, M2, and what money actually does)

- Banking and the expansion of the money supply (fractional reserve banking and money creation)

- Monetary policy (how the Federal Reserve impacts interest rates and the economy)

UWorld helps you master these topics by combining exam-style AP Macro Unit 4 questions with step-by-step explanations that actually teach you the reasoning behind each answer. Whether you’re reviewing for the AP Macro Unit 4 test or trying to understand money supply graphs, UWorld’s tools make the Financial Sector much easier to learn and apply on exam day.

How should I prepare for an AP Macroeconomics Unit 4 exam?

A simple and effective way to prepare for the AP Macroeconomics Unit 4 exam is to follow a Read, Watch, and Practice method. Start by reading the UWorld AP Macro Unit 4 study guide to build your understanding of financial assets, money supply concepts, and the basics of monetary policy. The study guide breaks down these ideas in a clear and organized way so you can understand the foundation before moving to more challenging questions.

After reading, reinforce what you learned by watching UWorld’s AP Macroeconomics Unit 4 video lessons. These videos help you visualize important graphs and show you how concepts like interest rates and the banking system work in real situations. Watching lessons helps you connect the information you reviewed and prepares you to handle different types of questions.

Finish by practicing with UWorld’s AP Macro Unit 4 practice questions. These questions are built to match the style and difficulty of the actual exam, and each one includes a detailed explanation that helps you understand your mistakes. Practicing with UWorld improves your confidence and strengthens your skills with the Financial Sector, which helps you walk into the Unit 4 exam feeling prepared.

Are any free resources available for AP Macroeconomics Unit 4?

There are several free resources that can help you study for AP Macroeconomics Unit 4, and the best place to start is with UWorld’s free trial. The trial gives you access to AP Macro Unit 4 practice questions, detailed explanations, and sample lessons from the Financial Sector. These free tools help you understand key topics like the money supply, interest rates, and monetary policy while showing you how real exam-style questions are structured. UWorld’s clear explanations make it easier to learn from mistakes and improve quickly.

You can also use the free materials provided by the College Board. Their website includes the official AP Macroeconomics Course and Exam Description, sample FRQs for Unit 4, and progress check-style questions. These resources are helpful because they show you exactly how the College Board writes questions on financial assets, the functions of money, and the banking system. When you combine these with UWorld’s practice questions, you get a more complete picture of what the AP Macro Unit 4 exam expects you to understand.

Khan Academy is another solid free option for reviewing AP Macroeconomics Unit 4. Their videos can help you review the money market graph, learn how banks expand the money supply, and understand basic monetary policy tools. These lessons work well as a quick refresher, especially when paired with UWorld’s detailed explanations and realistic practice questions. Using UWorld along with College Board and Khan Academy gives you a strong mix of guided practice, official expectations, and extra video support to prepare confidently for the Unit 4 exam.

What types of questions are on the AP Macroeconomics Unit 4 test?

The AP Macroeconomics Unit 4 test includes multiple-choice and free-response questions that focus on the Financial Sector. You will see questions on topics such as the money supply, banking, the functions of money, and basic monetary policy tools. UWorld helps you prepare by giving you AP Macro Unit 4 practice questions that match the style and difficulty of the real exam, which helps you know what to expect before test day.

Most multiple-choice questions ask you to read graphs, compare interest rate changes, or identify how different actions from the Federal Reserve affect the economy. Some questions also require simple calculations involving the money multiplier or shifts in the money market. UWorld explains each question clearly so you can understand why the correct answer works and how to avoid common mistakes.

The free response section includes questions that require written explanations and clear economic reasoning. You might need to show how banks create money, draw a money market graph, or explain how monetary policy affects inflation or output. UWorld prepares you for these types of questions by giving you guided practice, sample responses, and helpful explanations that show you how to structure your work. With regular practice, you will feel much more confident answering every type of Unit 4 question.

How can I improve my understanding of monetary policy for AP Macro Unit 4?

To improve your understanding of monetary policy for AP Macro Unit 4, start by reviewing the basics, including how the Federal Reserve uses tools like open market operations, the discount rate, and the reserve requirement. UWorld explains these ideas clearly, which helps you see how changes in the money supply influence interest rates and economic activity.

Next, focus on understanding the money market graph, since it appears often on the AP Macro exam. UWorld provides visual examples that show how shifts in the money supply affect nominal interest rates, which helps you connect the concepts more easily.

Finally, practice with UWorld’s AP Macro Unit 4 questions. These realistic questions strengthen your ability to apply monetary policy concepts and prepare you for both MCQs and FRQs.

How can I improve my score on the Free-Response Questions (FRQs) for Unit 4?

To improve your FRQ score for AP Macro Unit 4, start by reviewing the core Financial Sector concepts such as the money supply, money market graph, and monetary policy. UWorld helps you strengthen this foundation by giving you clear explanations that make it easier to remember key terms and relationships.

Next, practice drawing and labeling graphs quickly and correctly, since Unit 4 FRQs often require money market or bank balance sheet diagrams. UWorld walks you through these visuals so you know exactly what the exam expects.

Finally, work through UWorld’s Unit 4 FRQ-style questions to learn how to structure your responses. With consistent practice and feedback, you will become more confident writing clear and accurate economic explanations.

What is the "Financial Sector" unit's weight on the AP Macroeconomics exam?

The Financial Sector in AP Macro Unit 4 makes up an important part of the overall AP Macroeconomics exam. UWorld helps you understand these concepts clearly so you can recognize how banking, money supply, and interest rate questions appear on both MCQs and FRQs.

The weight for the Financial Sector is 18–23% of the total exam score. This range means you should expect several questions focusing on monetary policy, the money market graph, and how banks expand the money supply. UWorld’s Unit 4 practice questions match these topics closely and help you build confidence before exam day.

Because Unit 4 also appears in free-response questions, practicing with UWorld helps you explain graphs and policy changes accurately and efficiently.

Where can I find a good study guide for AP Macroeconomics Unit 4?

One of the best places to find a reliable and easy to understand study guide for AP Macroeconomics Unit 4 is UWorld. Their study guide makes the Financial Sector easy to understand by going over important topics like the money supply, banking, financial assets, and monetary policy. UWorld organizes everything so you can study at your pace and build a strong foundation before practicing questions.

UWorld’s AP Macro Unit 4 study guide also includes visuals, examples, and clear explanations that help you understand graphs such as the money market and loanable funds market. This makes it easier to AP Macro Unit 4 review difficult concepts and prepare for progress checks, MCQs, and FRQs.

If you want a study guide that feels clear, organized, and built for real students, UWorld is the best place to start. Their study tools help you review more effectively and give you the confidence you need for Unit 4 and the full AP Macroeconomics exam.

Can I find practice tests specifically for AP Macro Unit 4?

You can find practice tests specifically focused on AP Macro Unit 4, and the best place to start is UWorld. Their AP Macroeconomics Unit 4 practice questions mirror the style of actual AP exam items and focus heavily on the Financial Sector. This helps you get familiar with the question types you will see on test day.

UWorld creates practice sets that target the main Unit 4 topics, including money supply changes, banking, financial assets, and monetary policy. These questions also include detailed explanations, which makes it easier to learn from your mistakes and understand the logic behind every answer.

Studying with UWorld’s Unit 4 practice tests gives you a realistic sense of the timing, difficulty, and concepts you will encounter. It prepares you for MCQs, FRQs, and progress checks so you feel more confident going into the AP Macroeconomics exam.

Are there practice problems for the money multiplier and interest rate calculations in AP Macro Unit 4?

There are plenty of practice problems for money multiplier calculations and interest rate scenarios in AP Macro Unit 4, and UWorld is one of the best places to find them. Their question bank includes calculation-based items that help you understand how changes in reserve requirements or monetary policy affect the money supply and interest rates.

UWorld’s practice problems walk you through the math step by step so you can clearly see how to apply the money multiplier formula or interpret interest rate changes. This is especially helpful because these topics often appear on the AP Macro exam in both MCQs and FRQs.

Working through these UWorld problems strengthens your confidence with Unit 4 math and prepares you for the types of calculation questions the AP exam will include. It also helps you build speed and accuracy so you feel ready for any monetary policy scenario you encounter.